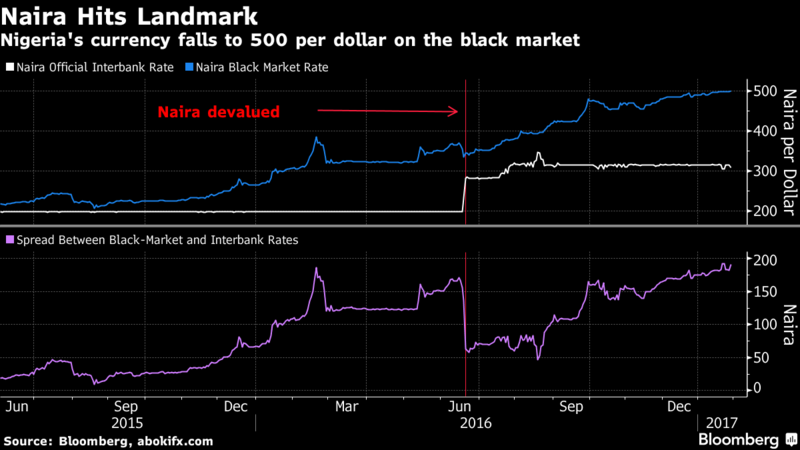

The Nigerian naira fell against the greenback to 500 on the black market as the nation’s dollar scarcity worsens, according to abokiFX.com, which collates prices from traders in Lagos each day.

The currency’s unofficial rate is now 38 percent weaker than the central bank’s level of 309. That’s despite several attempts by Governor Godwin Emefiele and the government to stem the rout after devaluation in June.

Nigeria’s central bank said it will allow the naira exchange rate to be market-driven, setting the stage for a devaluation of as much as 36 percent when a new trading system comes into effect June 20.

The Central Bank of Nigeria will select a group of around 10 primary dealers through which the naira will be traded. There will only be one exchange rate and the bank will intervene in the market to buy or sell foreign exchange “as the need arises,” Governor Godwin Emefiele told reporters in Abuja, the capital, Wednesday.

“We’re talking about an open, transparent two-way system,” Emefiele said. “The exchange rate would be purely market-driven. I don’t expect that any other exchange rate will be recognized.”

Emefiele has faced calls for more than a year to devalue the currency, as other oil exporters from Russia to Kazakhstan and Angola have done, amid a rout in crude prices since mid-2014 to around $50 a barrel.

Investment into Nigeria has shriveled as foreigners are put off by capital controls needed to defend the currency’s peg of 197-199 per dollar, while local businesses have struggled to import raw materials and equipment.

Three-month non-deliverable naira forward contracts surged 1.9 percent to 310 per dollar after the announcement, suggesting traders expect the Nigerian currency to trade around that level in the market, compared with the current official rate of 199.

Nigeria’s 2023 dollar bonds gained the most since 2014, with the yield falling 55 basis points to 7.1 percent, and stocks jumped 3.2 percent.

Emefiele said last month the central bank would implement a “flexible” exchange-rate policy to help alleviate a dollar shortage that has strangled the economy.

Gross domestic product contracted in the three months through March for the first time since 2004 and inflation accelerated to 15.6 percent in May, the highest rate in more than six years.

“It is something the market will want to see in operation to fully be able to take decisions concerning future investment, especially foreign investors,” Kunle Ezun, an analyst at Ecobank Transnational Inc., said by phone from Lagos. “The takeaway is that the central bank has not committed to any exchange rate.”

The naira will probably trade in a range of 280 to 350 against the dollar after the central bank implements its decision, analysts at Johannesburg-based Rand Merchant Bank said in a note on Wednesday before the announcement.

The central bank will also introduce over-the-counter naira futures trading to moderate currency volatility by moving non-urgent foreign-exchange demand from the spot to the futures market, Emefiele said. There will be no pre-determined spread on spot transactions, he said.

“The central bank is determined to make this market as transparent, liquid and efficient as possible,” Emefiele said. “The CBN will not allow this system to be undermined by speculators and rent-seekers.”

“It’s probably the best that the markets could have hoped for,” Ridle Markus, a Johannesburg-based analyst at Barclays’ Africa unit, said by phone. “It certainly seems like it will be a normal, free-floating currency. That would be positive.”

BloomBerg