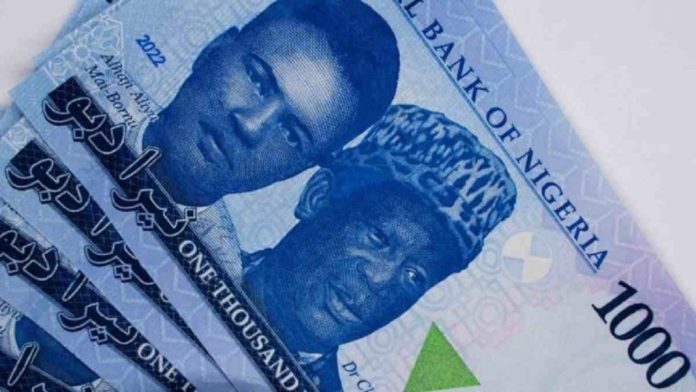

You know, in a country like Nigeria where the economy can feel like a rollercoaster—one day the naira is holding steady, the next it’s tumbling—it’s no wonder folks are scrambling for ways to keep their hard-earned money from slipping away.

I’ve talked to entrepreneurs in Lagos who swear by cryptocurrency as their secret weapon against inflation and devaluation. But is it really that straightforward? Let’s unpack how crypto is stepping in as a tool for wealth preservation amid all this uncertainty.

The Tough Reality of Keeping Wealth Intact in Nigeria

Picture this: You’ve saved up for years, only to watch inflation gobble up your naira’s value faster than you can say “economic reform.” It’s a common headache here. The naira has been on a wild ride, especially since the government floated it a couple of years back, letting market forces call the shots. That move sparked a sharp drop, making everything from imported gadgets to everyday groceries pricier. And don’t get me started on inflation—it’s been hovering in the double digits, outpacing whatever meager interest your bank account might offer.

These aren’t just abstract numbers; they hit real people hard. A business owner in Abuja might see their profits evaporate overnight because raw materials suddenly cost more. Or think about a young professional saving for a home—the dream keeps drifting further away as the currency weakens. It’s frustrating, right? This backdrop has pushed many to look beyond traditional banks and investments, straight into the digital world of crypto.

Before crypto burst onto the scene, people leaned on tried-and-true methods. Real estate was a big one—buying land or property in growing areas like Lekki or Maitama, hoping it appreciates. Then there were stocks on the Nigerian Exchange, bonds, or even stashing dollars under the mattress (or in a forex account, if you’re playing it safe). Fixed deposits at banks offered some stability too. But here’s the catch: These often demand a hefty upfront sum, and they’re not always easy to liquidate when you need cash quick. Plus, with regulatory shifts and market dips, they’re not foolproof.

Why Crypto Is Gaining Ground as a Shield

What makes crypto so appealing? For starters, it’s a solid hedge against inflation. Unlike fiat money that central banks can print endlessly, many cryptos have built-in scarcity. It’s accessible too—just grab your smartphone, connect to the internet, and you’re in. No need for fancy bank approvals. And for those sending money abroad or receiving remittances, it’s a game-changer—fast, cheap transfers without the usual red tape. Best of all, you control your assets directly via private keys, putting the power back in your hands.

But let’s be real; it’s not all sunshine. Crypto’s wild price swings can keep you up at night, and with regulations still in flux, you have to stay sharp. Still, for entrepreneurs dodging economic pitfalls or investors eyeing global opportunities, it’s becoming a staple in their toolkit.

Spotlight on the Top Cryptos for Protection

When it comes to picking cryptos for wealth preservation, Bitcoin leads the pack. Often dubbed “digital gold,” it caps out at 21 million coins— no more, no less. That scarcity mimics precious metals, making it a buffer against devaluation. Back in 2023, when the naira plummeted after policy changes, Bitcoin’s value in local terms shot up, helping holders maintain their buying power. It’s not tied to Nigeria’s economy, so when things get shaky here, it often holds firm or even climbs.

Beyond Bitcoin, there’s a whole lineup worth considering. Ethereum stands out for its smart contracts, which let you dive into decentralized finance (DeFi) apps—think earning interest on your holdings without a bank middleman. Ripple, or XRP, shines for speedy cross-border payments, perfect for Nigerians with international ties. Litecoin offers quicker, cheaper transactions than Bitcoin, making it handy for everyday use. And then there are stablecoins like USDT, tethered to the U.S. dollar for that extra layer of predictability. They’re like a digital version of holding forex, minus the hassle of physical cash.

Choosing the right one depends on your goals. If you’re after long-term storage, Bitcoin’s your bet. For more active management, Ethereum’s ecosystem opens doors to yields that beat traditional savings.

The Evolving Rules of the Game in Nigeria

Navigating crypto here means keeping an eye on the regulators—it’s a bit like dancing with a partner who’s constantly changing steps. Back in 2021, the Central Bank of Nigeria (CBN) dropped a bombshell, barring banks from dealing in crypto. That didn’t kill adoption; it just drove it underground, boosting peer-to-peer platforms. Fast forward to late 2023, and things softened—the CBN issued guidelines letting licensed virtual asset providers link up with banks again.

The Securities and Exchange Commission (SEC) is chiming in too, crafting rules to foster growth while shielding investors. Crypto isn’t official tender, but owning and trading it is fine as long as you follow the lines. It’s a work in progress, with aims to curb money laundering and boost financial inclusion. For professionals, this means opportunity: As frameworks solidify, crypto could integrate more seamlessly into business strategies, like hedging against currency risks in import-export deals.

Staying Safe: Dodging Pitfalls and Locking It Down

Honestly, crypto’s biggest draw—its openness—also invites trouble. Scams are rampant, from phony schemes dangling sky-high returns to phishing ploys after your keys. I’ve heard stories of folks losing fortunes to fake ICOs or social media hype. It’s heartbreaking, but avoidable.

To stay protected, dig deep before committing funds. Double-check wallet addresses and sites—typos can cost you dearly. Stick to trusted exchanges like Binance or local ones vetted by the community. And ignore those “guaranteed” profits on Twitter; if it sounds too good, it probably is.

On storage, security is non-negotiable. Hardware wallets like Ledger or Trezor keep your assets offline, away from hackers—think of them as a digital vault. Software wallets are convenient for mobile use but riskier if your device gets compromised. Avoid leaving everything on exchanges; remember the mantra, “Not your keys, not your crypto.” It’s about owning your wealth outright.

A mild contradiction here: While crypto empowers you, it demands discipline. Sure, it’s decentralized, but that freedom means no safety net if you slip up. Explaining it this way—treat it like guarding family heirlooms—helps drive the point home.

Wrapping It Up: Is Crypto Your Next Move?

In the end, as Nigeria grapples with economic headwinds, crypto emerges as a compelling ally for wealth preservation. It sidesteps the naira’s woes, offering a global lifeline that traditional options sometimes can’t match. From Bitcoin’s steadfast scarcity to stablecoins’ reliability, there’s a fit for various risk appetites.

But success hinges on smarts: Grasp the regs, mitigate risks, and secure your holdings. Tools like portfolio trackers on apps such as CoinMarketCap can help monitor trends, tying into broader financial planning. With the right approach, crypto isn’t just a hedge—it’s a step toward greater financial autonomy in uncertain times.