The Governor of Ebonyi State, David Umahi, has expressed his state’s disapproval of Lagos, Rivers, and other states in pursuit of collection of value-added tax (VAT).

Umahi noted that he backs the VAT collection by the Federal Inland Revenue (FIRS) and its subsequent distribution among the 36 states of the federation.

Following the ruling by a Federal High court in Rivers state, there have been arguments surrounding VAT collection between FIRS and state governments.

Last week, the court of appeal in Abuja directed Rivers and Lagos to maintain status quo (to maintain the situation as it existed before), pending the determination of an appeal filed by FIRS.

READ ALSO: How To Close Your Nigerian Bank Account And Make Full Withdrawals

In a swift reaction to the appeal court order, the Rivers State approached the supreme court to set aside the former’s directive.

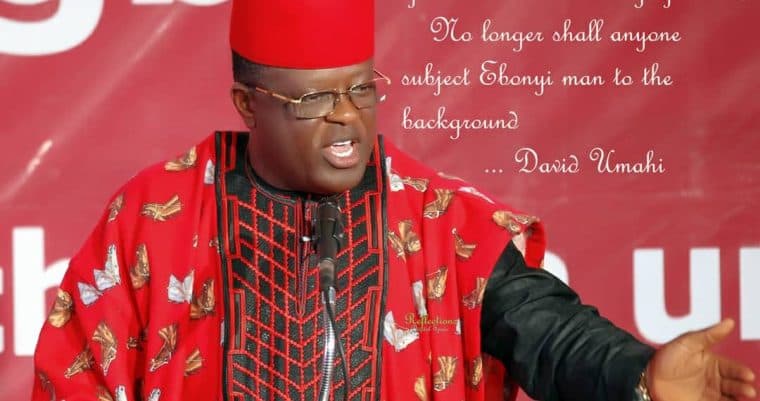

The Ebonyi State Governor spoke at a state dinner hosted in honour of a former chief of army staff and Nigerian Ambassador to the Republic of Benin, Tukur Buratai, in which noted that true federalism should be administrative restructuring.

“Evil will continue to thrive if good people keep quiet, we must make Ebonyi State very exceptional by rising to the challenges,” Umahi said.

“When we shout true federalism, I say, I agree; but it should be administrative restructuring.

“Ebonyi state is not in support of any state collecting VAT. We are in support that FIRS should continue to collect tax and share.”

Umahi said that he is willing to debate any of his colleagues in the opposition party, the Peoples Democratic Party, who believes he has outperformed him in the delivery of the dividends of democracy to citizens, than the All Progressives Congress (APC)-led administration in Ebonyi State.

Besides Ebonyi State, a similar call was made by the Gombe State government for Rives and Lagos State to reconsider their resolution on collecting value-added tax (VAT) in their states.