Nigeria’s financial inclusion drive received a major boost as leading Information and Communications Technology (ICT) company, MTN Group signed an MoU with Pan-African Bank Ecobank, to deliver financial services to millions of people across the African continent.

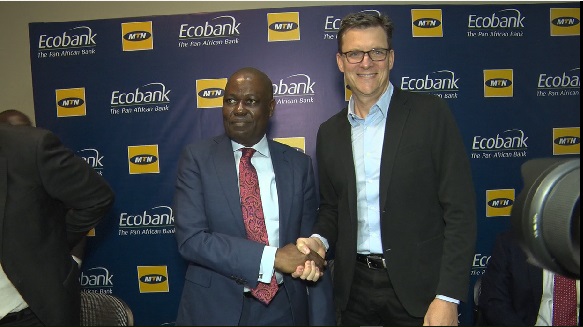

The partnership which was announced Tuesday 10th April, 2018 at a launch event in Lagos, brought together top figures from both organizations and the media.

This collaboration is expected to enable Ecobank and MTN Mobile Money customers carry out transactions such as money transfer between mobile money wallets and bank accounts. Also, this would provide leveraging of Ecobank and MTN’s assets to digitise international remittance, foster product innovation in the field of mobile saving and lending, and offer digital payment solutions to consumers, merchants and corporates.

Speaking on the collaboration, MTN Group President and CEO, Rob Shuter said:

“Partnerships between banks and mobile money operators are fundamental in the mobile money ecosystem, hence our long-standing partnership with Ecobank in many of our markets aimed at driving financial inclusion. We are excited to be taking this partnership to the next level as this latest development will spearhead innovative initiatives which will deepen financial access on the continent.”

He added that MTN is open to working with other financial institutions in order to bridge the financial divide.

Commenting on the collaboration, Ade Ayeyemi, the Chief Executive Officer of Ecobank, said:

“Combining Ecobank’s innovative digital banking range with MTN’s enormous subscriber base means that virtually every African can now have an instant bank account, savings accounts, loans and make instant remittances on their mobile phone.”

“Ecobank’s digital strategy has long been committed to providing banking facilities to the mass market. We have already made giant strides in our mission to ensure financial inclusion and today’s agreement with MTN will greatly accelerate the easy availability of banking facilities to the previously unbanked.”

Although over 80% of Africans have mobile phones, only a quarter (28%) of them have a bank account. However, mobile banking and e-wallets offer a range of alternative payment methods as well as lending and savings services.

The Financial Inclusion Insights of 2015 also showed that only about 2 in 5 Nigerian adults own a financial account while just twelve percent of Nigerians are aware of mobile money services.

The recent financial inclusion report by FinScope Survey shows that financial inclusion can be stepped up by linking mobile money platforms to financial institutions. This, experts say, would create credit history for clients and foster financial inclusion.

With this partnership, MTN will leverage Ecobank’s payments infrastructure to facilitate money transfer via mobile wallets across the MTN and Ecobank footprints. It will also spearhead new innovations to initiate financial access in Africa and beyond as well as encourage other financial institutions to leverage on MTNs ecosystem and distribution.

The Ecobank-MTN partnership will enable; Bank-to-MTN Mobile Money wallet and wallet-to-bank transfers and cardless ATM withdrawal for MTN Mobile Money users. The partnership will use the rapid transfer platform to provide MTN Mobile Money users to make intra-Africa funds transfers. The partnership will provide savings accounts and lending solutions to MTN Mobile Money users.

MTN Mobile Money agents will be able to create and redeem e-money through Ecobank branches. Ecobank merchants can also accept payments from MTN Mobile Money users. The use of MTN Mobile Money as a payment solution in Ecobank’s corporate offering will enable salary payment and corporate supplier’s payments to be made through MTN Mobile Money.