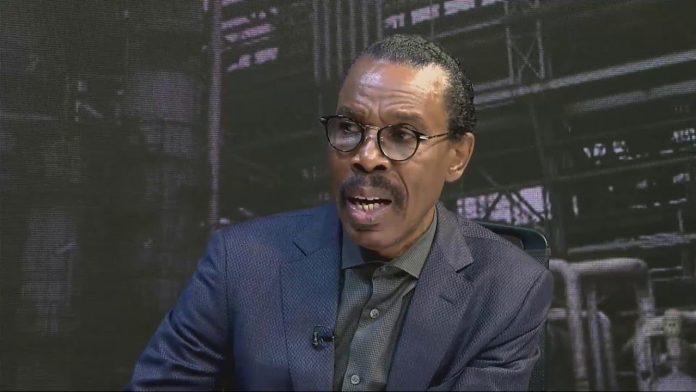

The Federal Government (FG) must restructure Nigeria’s debt to seek better credit facility financing terms. This is according to Bismarck Rewane, the Chief Executive Officer (CEO) of the Financial Derivatives Company (FDC).

Speaking at the FDC economic forum with the theme: “Corporate resilience: Economic recovery against unforeseen pandemics,” where he made this submission, Rewane said should the Nigerian government restructure its debt, rescheduling would take place, and better terms of loan repayments would be considered.

“First of all, restructure your debt, reschedule it and seek better terms. In any case, you have to be honest with yourself and use the money for the purposes you borrow. You cannot borrow to steal,” he explained.

Addressing the global financial crisis and its spillover effect on Nigeria, he expressed optimism that Nigeria was on the path toward growth.

Rewane said: “Nigeria has had some crises, more crises than the global trend. But in some cases, Nigeria has also benefited from windfalls. This crisis is now where Saudi Arabia, Angola, and Russia are making a windfall and gains from it.

“But I think that we didn’t take advantage of it because we had our own domestic vandalism and all of that, but once we get a hold of this, which is going to come in next year, then you will see that our recovery is going to be much more dynamic than we believe.

“So, again, I’m highly optimistic about the fact that things will change and change for the better.”

He, therefore, advised the government to be, “more efficient in your collection of taxes, but also you have to reduce the number of taxes. The burden of the tax itself is a problem.

“So, I also believe that the lower the tax rate, the more compliant people are going to be, therefore, we should go more on the efficiency of tax, and again, more credible leadership and policies, that if we can be honest with people, then people are more willing to pay taxes than if we are dishonest with the people.”

“Trust deficits exists and it is an accumulative pattern of bad behavior that has led to where we are. And I’m talking about the last 60 to 70 years so it’s not just now.

“So, it has become the perverse nature of leadership and followership. We have come to accept falsehood as part of the DNA of Nigeria, so we’ve got to change that and it has to start with some very ruthless and drastic steps,” he added.

DMO reveals Nigeria’s debt

According to the Debt Management Office (DMO), Nigeria’s debt stood at N42.84, trillion, with the World Bank predicting that debt service to revenue would increase to 102.3% by the end of 2022.