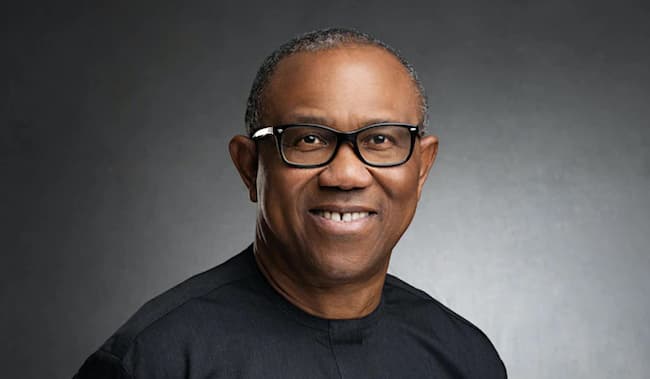

Peter Obi, former governor of Anambra State, urges the federal government to secure public consensus before implementing the tax reform bills currently before the National Assembly.

In a statement, Obi stresses the importance of robust public engagement, highlighting that while tax reform is necessary, it must be based on transparency and inclusivity to build trust and legitimacy.

Obi emphasizes the need for public hearings to gather diverse perspectives and ensure the reforms reflect the interests of all Nigerians.

“Reforms of this magnitude require careful consideration and extensive deliberation. Public hearings provide an avenue for Nigerians from all sectors to contribute their opinions, ensuring inclusivity in policymaking,” Obi states.

He adds that the government must actively educate citizens about the proposed changes and secure their support. “Trust and legitimacy are essential to effective governance, and without them, even well-intentioned reforms may fail,” he explains.

Obi warns that tax reforms should not focus solely on increasing government revenue. Instead, he calls for a broader evaluation of the reforms’ impact on the nation’s sustainability and regional equity.

“It is critical to consider how these changes affect all regions to ensure fairness and inclusivity. Reforms must balance revenue generation with the overall welfare of the country,” he says.

He urges the federal government to prioritize deliberation, transparency, and public engagement, arguing that such an approach aligns with the principles of democracy.

Obi’s remarks follow widespread concerns about the proposed tax reforms, which include adjustments to Value Added Tax (VAT) allocation between federal and sub-national governments.

Currently, VAT revenue is distributed as 15% to the federal government, 50% to states and the Federal Capital Territory (FCT), and 35% to local governments, with factors such as equality and population influencing allocations. Proposed changes have sparked opposition, particularly among northern stakeholders, who argue that the reforms may disproportionately disadvantage their region.

Obi emphasizes the importance of public consensus and inclusive governance in the tax reform process, urging the government to ensure fairness, transparency, and trust as it seeks to implement these critical changes.