Let’s be honest—trying to keep up with social media image specs is like trying to catch confetti in a hurricane. One day it’s 1:1, the next it’s 4:5. Suddenly, your perfectly planned carousel looks like it went through a shredder. If you’ve ever spent hours designing a campaign banner only for Instagram to crop it awkwardly or for LinkedIn to make it look like it was shot through a potato, you’re not alone.

In this feature, we’re cutting through the noise to give you something concrete—a complete, updated cheat sheet of image sizes for every major social platform in 2025. Whether you’re a digital marketer juggling multiple client accounts, a content creator finessing your personal brand, or an SEO analyst looking to boost CTRs with sharp visuals, this is your playbook.

So, shall we?

Why Social Media Image Sizes Still Matter in 2025

You might be wondering—do image dimensions really make that much of a difference anymore?

Short answer: Absolutely. Long answer: Compression algorithms, automatic cropping, and platform-specific layout shifts can murder your visuals if you’re not careful.

A blurry cover photo on Facebook? That’s your brand’s first impression gone. A stretched-out Reel preview on Instagram? Engagement down. A misaligned LinkedIn ad image? Budget wasted.

And let’s not forget the mobile-first reality of today’s social universe. What looks perfect on desktop might end up looking like a bad meme on mobile. That’s why understanding exact specs—down to the last pixel—still gives you a competitive edge.

Let’s get into it.

Facebook Image Sizes – The Crowd Favorite

With almost 3 billion monthly users, Facebook remains a titan for both B2C and B2B marketers. If you’re targeting anything from grandma’s hobby shop to a Fortune 500 CEO’s feed, Facebook’s your playground.

Essentials for 2025:

- Profile Picture: 180 x 180 px

- Cover Photo: 851 x 315 px

- Feed Image: 1200 x 630 px

- Stories: 1080 x 1920 px

- Event Banner: 1920 x 1005 px

- Fundraiser: 800 x 300 px

- Ads: 1080 x 1080 px (1:1 or 1.91:1)

Quick Tip: Use PNGs for sharper profile photos and JPGs for faster-loading feed images.

Twitter (X) Image Sizes – For Real-Time Rebels

Twitter (or should we say “X” now?) has become less about just tweeting and more about building mini-communities. Whether you’re reacting to trends or riding hashtags, visuals still play a key role in engagement.

Essentials for 2025:

- Profile Photo: 400 x 400 px

- Header: 1500 x 500 px

- In-Stream Photo: 1600 x 900 px

- Card Image: 120 x 120 px

- Ads (Standard): 1200 x 1200 or 1200 x 628 px

- App/Website Buttons: 800 x 418 / 800 x 800 px

Hot Take: Twitter might be the most overlooked ad platform visually. Bold, clean images often outperform flashy ones. Think “headline first,” then image.

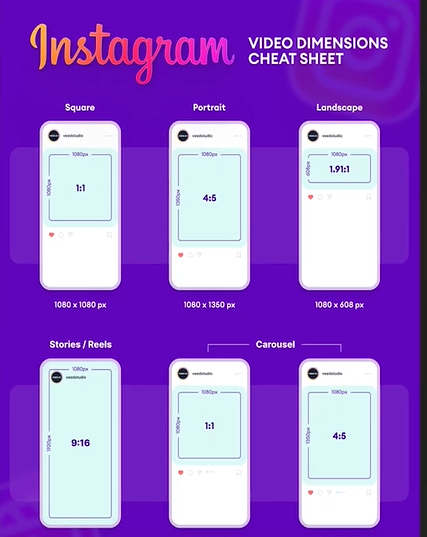

Instagram Image Sizes – The Aesthetic Arena

Instagram has long been the golden child of visual-first content. But here’s the twist: square grids aren’t the only players anymore. With vertical content reigning supreme, knowing your ratios is half the game.

Essentials for 2025:

- Profile Picture: 320 x 320 px

- Portrait Post (RECOMMENDED): 1080 x 1350 px

- Square Post: 1080 x 1080 px

- Landscape: 1080 x 566 px

- Stories/Reels: 1080 x 1920 px

- Carousel: Same as posts (portrait, square, landscape)

- Ads: Same as respective post formats

Real Talk: Instagram compresses aggressively. Upload at the highest possible resolution to avoid losing sharpness—especially in Stories.

LinkedIn Image Sizes – The Suit-and-Tie Feed

LinkedIn isn’t all stuffy suits anymore. With more creators hopping on and brands investing in community storytelling, visual polish is your best friend.

Essentials for 2025:

- Profile Picture (Personal): 400 x 400 px

- Cover Photo (Personal): 1584 x 396 px

- Company Logo: 300 x 300 px

- Company Cover: 1128 x 191 px

- Post Image/Link Preview: 1200 x 627 px

- Ad Formats:

- Horizontal: 1200 x 628 px

- Square: 1200 x 1200 px

- Vertical: 628 x 1200 px / 600 x 900 px / 720 x 900 px

Power Move: Want to stand out on the feed? Try color-contrasted border designs on carousel posts. It’s subtle, but scroll-stopping.

Pinterest Image Sizes – Where Visuals Sell

Pinterest users come to shop—not scroll. That makes your visual size and clarity absolutely crucial. And with vertical pins getting the most visibility, you don’t want to mess this up.

Essentials for 2025:

- Profile Picture: 165 x 165 px

- Cover Photo: 1920 x 1080 px

- Standard Pin: 1000 x 1500 px (2:3 ratio)

- Square Pin: 1000 x 1000 px

- Story Pin / Idea Pin: 1080 x 1920 px

- Ad Formats: Same as standard pins +

- Carousel: 1080 x 1080 or 1000 x 1500 px

- Video Ads: Various formats (1080 x 1080, 720 x 1080, etc.)

Quick Hack: Longer pins (with a 2:3 or even 1:2.1 ratio) tend to perform better because they occupy more screen real estate in the feed.

YouTube Image Sizes – For the Long Haul

Even though YouTube’s primarily a video platform, every image counts—especially when it comes to thumbnails and banners. A bad thumbnail can tank your CTR faster than you can say “skip ad.”

Essentials for 2025:

- Profile Picture: 800 x 800 px

- Banner Image: 2048 x 1152 px

- Video Size (HD): 1920 x 1080 px

- Shorts / Stories: 1080 x 1920 px

- Thumbnail: 1280 x 720 px

- Ad Formats:

- In-Stream: 1920 x 1080 px

- In-Feed: 1280 x 720 px

- Overlay/Display: 300 x 60 px or custom

Pro Tip: Think of your thumbnails as mini billboards. Use clear facial expressions, contrasting colors, and big, bold text. That’s how you get the click.

TikTok Image Sizes – Short, Fast, Visual

If Instagram’s a runway, TikTok’s a rave. It’s chaotic, loud, and incredibly addictive. And while it’s video-first, your profile image and carousel visuals still need to be razor-sharp.

Essentials for 2025:

- Profile Picture: 200 x 200 px

- Videos / Stories / Reels: 1080 x 1920 px (9:16)

- Carousel Images: 1080 x 1920 px

- Ads: 1080 x 1920 px

Fun Fact: TikTok users are 1.7x more likely to act on the content they see versus other platforms. So yes, your image specs matter here—big time.

Google Business Profile – Your Digital Front Door

Let’s not ignore the silent powerhouse—Google Business Profile. When people Google your brand, what they see here shapes their decision before they ever hit your site.

Essentials for 2025:

- Logo: 720 x 720 px

- Cover Photo: 1024 x 576 px

- Image Post: 720 x 720 px

- Video Post: 1280 x 720 px (max 30 sec)

Little Detail, Big Impact: Crisp logos here can influence your local SEO impressions. Think of it as your brand handshake—make it firm and clean.

So, What Now?

Here’s the kicker—platforms update specs all the time. Sometimes it’s subtle. Sometimes it’s a full-blown layout redesign that breaks your entire content calendar. That’s why having a cheat sheet like this isn’t just convenient. It’s survival.

Pro Moves for Busy Creators:

- Bookmark this article

- Use tools like Canva, Adobe Express, or Figma with preset templates

- Batch resize with apps like Image Resizer or Kapwing

- Use Hootsuite or Buffer to preview post formatting across platforms

- Recheck specs quarterly—platforms don’t always announce changes loudly

Final Thoughts

You can write the best copy, film the slickest video, and drop the most genius hashtag… but if your image gets cropped wrong or looks low-res? People scroll. Attention is the currency now. And visuals are your first transaction. Make them count. You don’t need to chase perfection—but you do need precision. So save this cheat sheet. Stick to the pixels. And post with confidence.