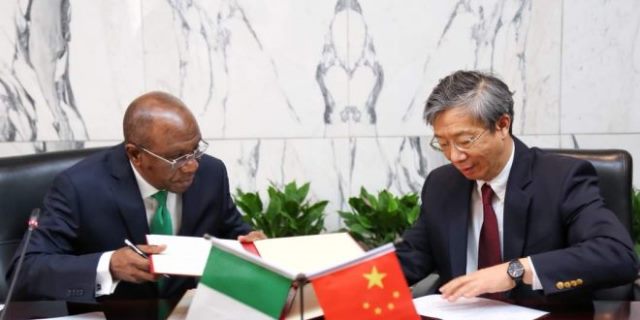

Following the $2.5 billion bilateral currency swap agreement signed last month between the Central Bank of Nigeria (CBN) and the People’s Bank of China (PBoC), the CBN has said it will incentivise importers and traders who tender their invoices in Renminbi (RMB).

This was revealed at the Bankers’ Committee meeting Thursday.

The CBN last week announced plans to start bi-weekly auctions of the Chinese currency.

But briefing journalists at the end of the meeting in Lagos, the Chief Executive, Stanbic IBTC Bank, Mr. Demola Sogunle, pointed out that the central bank recently issued regulations for transactions in Renminbi.

He added: “As we speak now, China is the biggest trading partner with Nigeria and on the back of the currency swap; Nigeria has access to RMB 15 billion in terms of facilitation of trade.

“So, what has come out of the Bankers’ Committee meeting today is that importers of Chinese equipment, machinery, goods are being encouraged to get invoices in RMB.

“The CBN is willing to incentivise importers so that instead of bringing invoices in dollars they should bring invoices in RMB.

“To the extent of that bilateral currency swap is in place and Nigeria is able to tap into about RMB 15 billion, we should be able to use that to facilitate trade and this should speak directly to encouraging small and medium scale enterprises playing in the Nigerian-Chinese trade corridor.”

Throwing more light on the benefit of the call by the CBN for traders to tender their invoices in the Chinese currency, Sogunle said it means an importer would actually take lesser naira to the banks.

He noted that the move was to encourage importers to receive invoices in RMB instead of US dollars.

He explained: “One of the incentives would be that a percentage spread would be given to any importer that is giving RMB invoice for settlement instead of bringing a dollar invoice.

“So, when you look at the overall cost of the naira, if you bring a RMB invoice, it is going to be cheaper for the importer coming to CBN to get currency.”

Also commenting on how the bilateral currency agreement would support the country’s external reserves accretion, the Stanbic IBTC boss said: “We have got almost $48 billion in our reserves and because we trade a lot with China, if we are able as a country to continue to bring in machinery and equipment without depleting our dollar reserves, then the external reserve would not be under threat.

“So, with the RMB 15 billion in place, we are in a very good position. That is why it is important to encourage importers to bring invoices in RMB instead of dollars.”

Also speaking on how the arrangement would benefit importers who present RMB invoices to banks, the chief executive of Keystone Bank Limited, Mr. Obeahon Ohiwerei, said: “Anytime invoices are obtained in dollars for import that is going to come from China for instance, there is usually at least a 10 per cent mark up, so that 10 per cent is the minimum savings instantly.”

On his part, the Director, Banking Supervision, CBN, Mr. Ahmad Abdullahi, who was also at the media briefing, said the central bank was in a good shape to curtail any foreseen circumstances in the macroeconomic environment.

Abdullahi said: “For the economy, the committee recognised the mixed signals coming from the global economy. The rise in US interest rate and its impact on the Nigerian economy, the trade wars and its impact also on the Nigerian economy, the tax cut in the United States and what it means for capital outflow for emerging economies like Nigeria.”

Similarly, the Chief Executive Officer of the United Bank for Africa (UBA), Mr. Keneddy Uzoka, said: “CBN is in a very strong position to defend the exchange rate. The CBN has been intervening in all the markets and in the most recent times, gives the BDCs money three times in a week.”