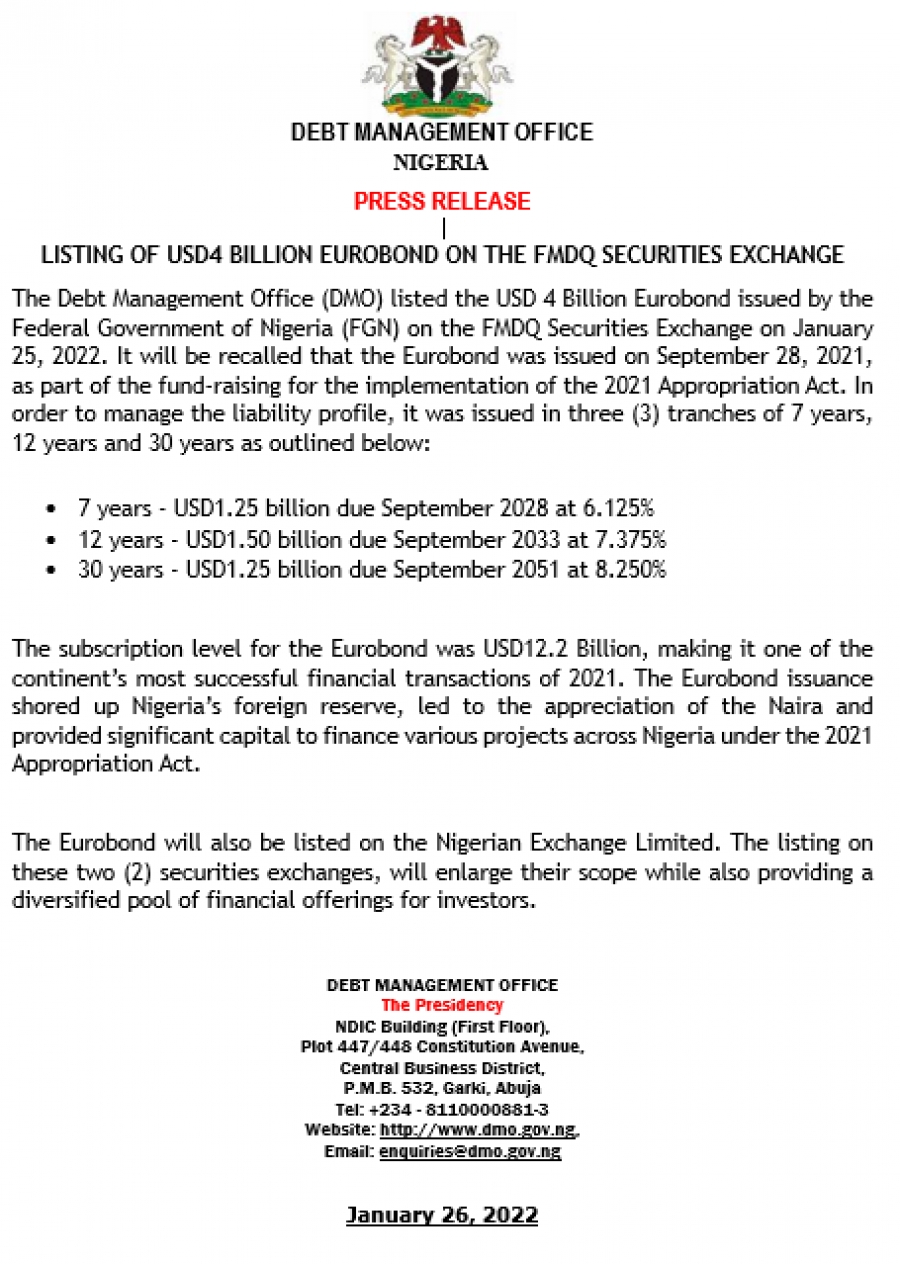

The Debt Management Office (DMO) has listed the $4 billion borrowed through Eurobond in September 2021 on the FMDQ Securities Exchange.

DMO announced the listing via a statement on its website on Wednesday.

“The Debt Management Office listed the $4 billion Eurobond issued by the Federal Government of Nigeria on the FMDQ Securities Exchange on January 25, 2022,” it said.

The Eurobond was issued on September 28, 2021, as part of the fundraising for the implementation of the 2021 Appropriation Act.

It was issued in three tranches of seven years for $1.25 billion due September 2028 at 6.125 per cent, 12 years for $1.50 billion due September 2033 at 7.375 per cent, and 30 years for $1.25 billion due September 2051 at 8.250 per cent.

The DMO said, “the subscription level for the Eurobond was $12.2 billion, making it one of the continent’s most successful financial transactions of 2021.

“The Eurobond issuance shored up Nigeria’s foreign reserves, led to the appreciation of the naira and provided significant capital to finance various projects across Nigeria under the 2021 Appropriation Act.”

The debt office also said that the Eurobond would be listed on the Nigerian Exchange Limited to provide a diversified pool of financial offerings for investors.