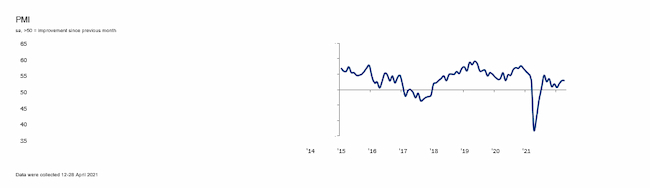

PMI

April data revealed another solid overall expansion in the Nigerian private sector, underpinned by further growth in output and new orders. Firms added to their workforces and inventory holdings in anticipation of greater demand, while vendor performance improved further. A rise in headcounts allowed firms to clear their backlogs, with the rate of depletion the second-sharpest in the seven-year history of the survey.

Inflationary pressures continued to build however, with material shortages contributing to the sharpest overall rate of inflation in the series to date. Firms responded by raising selling prices to protect their profit margins.

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI®). Readings above

50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

READ ALSO: Nigerian Govt Extends NIN-SIM Linkage To June 30

At 52.9 in April, the headline PMI registered a rate of growth that was unchanged from that in March and extended the period of expansion to ten consecutive months.

Higher domestic demand led to a rise in new orders, with the rate of growth substantial in April. This supported another expansion in output, albeit one that was softer than that in March. Sector data revealed that agriculture posted the fastest rise in output followed by services and manufacturing respectively. Wholesale & retail meanwhile recorded a decline.

Sources: Stanbic IBTC Bank, IHS Markit.

To support the sustained growth in output, firms increased their purchasing activity, with the rate of growth the quickest in 14 months. According to panellists, expectations of higher customer numbers, and business expansion plans fuelled stockpiling efforts. Lead times shortened, meanwhile, with quiet road conditions and increased competition amongst vendors often mentioned.

Amid efforts to expand output, Nigerian private sector firms added to their headcounts at the start of the second quarter. The rate of growth was solid and the sharpest in nearly three years. A rise in employment also contributed to a marked reduction in backlogs, which fell at the second-sharpest rate on record.

Elsewhere, price pressures intensified with overall input price inflation quickening to the fastest in the series. Material scarcity in particular, and higher staff costs, were linked to the uptick. Subsequently, firms raised selling prices to protect their profit margins.

Finally, sentiment regarding the year ahead remained upbeat, with plans to expand operations and invest in marketing fuelling hopes. That said, expectations were below the long-run series average suggesting uncertainty surrounding the economic impact of COVID-19 weighed on optimism.