Nigeria’s financial markets opened November 2025 on a turbulent note as both the naira and equities tumbled sharply following controversial remarks from U.S. President Donald Trump, who hinted at possible military intervention in Nigeria over alleged religious persecution.

Latest figures from the Central Bank of Nigeria (CBN) revealed that the naira, which had reached a 2025 high of ₦1,421.73 per dollar, weakened to ₦1,436.34/$ on Monday — a 1.03 per cent depreciation or a ₦14.61 loss in a single trading day. At the parallel market, the local currency slid further to ₦1,455/$ amid surging investor anxiety and increased demand for foreign exchange.

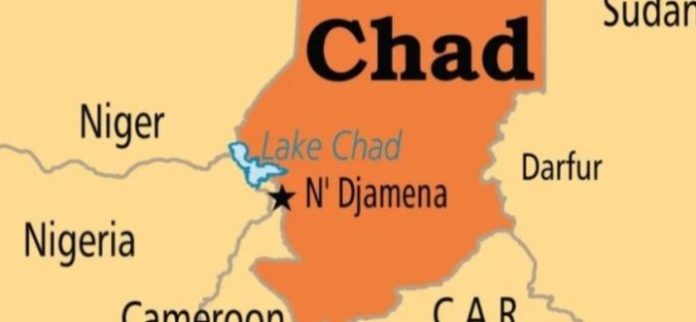

The sharp decline followed a weekend of escalating diplomatic tension after Trump, via his Truth Social platform, accused Nigeria of “Christian genocide” and directed the U.S. Department of War to prepare for “possible action” should the alleged killings continue. His remarks, which labelled Nigeria as a “country of particular concern,” quickly sparked global debate and uncertainty over the political and economic fallout for Africa’s largest economy.

The reaction across the markets was swift. Trading sentiment at the Nigerian Exchange Limited (NGX) turned negative as the All-Share Index dropped by 0.25 per cent to close at 153,739.11 points, cutting year-to-date gains to 49.37 per cent. Market capitalisation fell by ₦245.88 billion to settle at ₦97.58 trillion.

Heavy selloffs in Aradel Holdings (-9.21 per cent) and Access Corporation (-3.07 per cent) led the downturn, as investor confidence wavered. Of the active stocks, 38 declined while 19 advanced. Union Dicon topped the gainers’ list with a 9.93 per cent rise, whereas Honeywell Flour Mills suffered the biggest loss, plunging 10 per cent.

Market activity also slowed considerably. Total traded volume and value fell by 87.94 per cent and 44.64 per cent respectively, to 627.5 million units worth ₦25 billion. United Bank for Africa (UBA) accounted for the largest share of trading, representing 21.8 per cent of the total volume (136.8 million units) and 22.2 per cent of total value (₦5.5 billion).

Sectoral performance showed a mixed picture. The Oil & Gas (-3.94 per cent), Commodities (-1.85 per cent), Insurance (-1.48 per cent), and Banking (-0.22 per cent) indices all closed in the red, while the Consumer Goods sector edged up 0.49 per cent. The Industrial Goods index ended the session flat.

In the fixed-income space, investor appetite for Nigeria’s Eurobonds also weakened. According to Cowry Asset Management, average yields rose by 5 basis points to 7.70 per cent as global investors turned risk-averse amid rising geopolitical tensions. Bloomberg data showed that Nigeria’s dollar-denominated bonds were the worst performers among emerging markets on Monday, with all ten Eurobond notes ranking among the global laggards. Bonds maturing in 2047 fell the steepest, losing 0.6 cents to 88.26 cents on the dollar before recovering slightly later in the day.

Despite the volatility, some market experts believe the panic may be short-lived. Tilewa Adebajo, Chief Executive Officer of CFG Advisory, told The PUNCH that the decline was likely “a temporary overreaction.”

“This looks like a short-term blip,” Adebajo noted. “International market prices are already stabilising, and given Nigeria’s recent removal from the FATF Grey List, long-term fundamentals remain solid.”

However, Dr. Muda Yusuf, Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), cautioned that Trump’s rhetoric could seriously damage investor sentiment.

“The U.S. President’s threat of military intervention is unnecessary, destabilising, and economically damaging,” Yusuf said in a policy statement. “Such pronouncements raise investor risk perception and erode market confidence in Nigeria’s economy.”

He further advised that Nigeria should continue to strengthen its internal security and governance mechanisms while pursuing international engagement through dialogue rather than confrontation.

“Any form of unilateral military action,” Yusuf warned, “would endanger Nigeria’s economic stability, disrupt regional peace, and aggravate humanitarian challenges. The prudent path forward lies in diplomacy, cooperation, and mutual respect for sovereignty.”

As global observers await clarity on Washington’s next steps and Abuja’s diplomatic response, analysts agree that restoring investor confidence will depend heavily on calm policy communication, transparency, and consistency from both the Federal Government and the Central Bank of Nigeria.

![Stanbic IBTC logo[1]](https://bizwatchnigeria.ng/wp-content/uploads/2025/05/Stanbic-IBTC-logo1.jpg)