The Ogun State Government has achieved a major milestone in retiree welfare by successfully clearing the backlog of pension and gratuity arrears for workers who retired between 2012 and 2020. The Commissioner for Finance and Chief Economic Adviser, Mr. Dapo Okubadejo, disclosed this on Tuesday, February 17, 2026, during a media parley in Abeokuta focused on the 2026 budget breakdown.

He clarified that while these inherited debts were tied to the old Defined Benefits Scheme (DBS), the current administration has maintained a perfect record of zero defaults on monthly pension obligations since taking office in 2019.

The financial scale of this intervention is significant, with the state disbursing a total of ₦23.3 billion in gratuities to state retirees and another ₦32.8 billion to local government pensioners during the period under review.

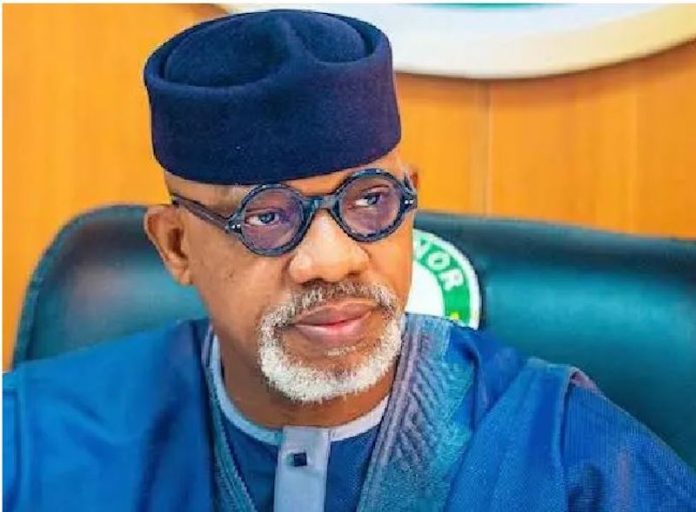

To further bridge the gap between the old system and the current Contributory Pension Scheme (CPS), Governor Dapo Abiodun has approved a first-of-its-kind Additional Pension Benefit (APB). This new policy is designed to provide a “gratuity-like” lump sum to retirees under the CPS, a benefit previously absent from the contributory model, and is scheduled for full integration following legislative amendments to the state’s pension laws.

Despite these payments, the state continues to face pressure from the Nigeria Union of Local Government Employees (NULGE), which recently issued a seven-day strike ultimatum over local council autonomy and unremitted pension savings.

Commissioner Okubadejo maintained that the state’s ability to settle these long-standing debts is a direct result of aggressive growth in Internally Generated Revenue (IGR), which has surged from ₦50 billion in 2019 to over ₦240 billion in 2025. With the 2026 budget projected at ₦1.668 trillion, the government intends to utilize its expanded fiscal space to ensure that recent retirees, specifically those from July 2025, receive palliative support while their final documentations are processed.