- President Donald Trump said in a tweet that China, the European Union and others are manipulating currencies and putting the U.S. at a disadvantage.

- The comments come a day after the president rued during a CNBC interview that Federal Reserve interest rate hikes were making the U.S. less competitive

President Donald Trump ramped up his criticism of global monetary policy as well as his own central bank, saying in tweets that multiple nations are manipulating currencies to the detriment of the U.S.

The comments come a day after Trump, in a CNBC interview, ripped U.S. trading partners including China and the European Union and said the nation needs a weak dollar.

https://twitter.com/realDonaldTrump/status/1020287981020729344

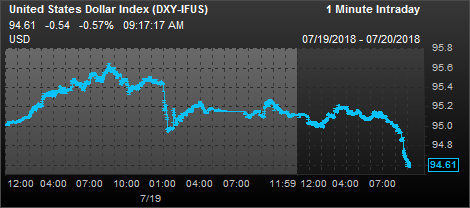

Immediately after the president’s tweets, the euro, yuan and yen strengthened against the dollar. The dollar index, which measures the U.S. currency against a basket of its global peers, was off nearly 0.5 percent a half-hour before the stock market opened on Wall Street.

In his CNBC interview, Trump was candid in his feelings about where the U.S. stands in the foreign exchange market.

He estimated that currency imbalances were costing the U.S. $150 billion with European Union nations.

“They’re making money easy and their currency is falling,” Trump said on “Squawk Box.” “In China their currency is dropping like a rock and our currency is going up, and I have to tell you it puts us at a disadvantage.”

The U.S. and EU have long had a cooperative trading arrangement, with the European currency traditionally running well ahead of the greenback. China, conversely, has long been faulted for keeping its currency low, though it has not been officially labeled a manipulator by the U.S. Treasury Department.

“Treasury is strongly concerned by the lack of progress by China in correcting the bilateral trade imbalance and urges China to create a more level and reciprocal playing field for American workers and firms,” Treasury said in a report earlier this year on nations whose currency practices it is watching.

Trump said his decision to slap tariffs on billions in imported goods is part of his strategy to level the global playing field, which he said has been unbalanced due in part to tightening U.S. monetary policy while other central banks remain accommodative.

“They’re not doing what we’re doing and we already have somewhat of a disadvantage, although I’m turning that into an advantage,” he said.

In a related tweet, the president also kept the heat on the Federal Reserve. He had told CNBC that he was “not thrilled” that the U.S. central bank is raising interest rates as the economy improves, and in his tweet repeated his claim that the Fed is undoing the economic progress the country has seen during his presidency.

https://twitter.com/realDonaldTrump/status/1020290163933630464

It is also unusual for a president to openly critique monetary policy, though Trump said he is not concerned by perceptions that his comments could compromise the Fed’s independence.