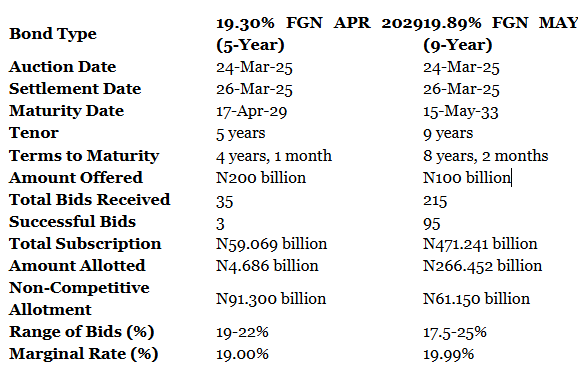

The Debt Management Office (DMO) has publicized the outcomes of its most recent Federal Government of Nigeria (FGN) bond tender for March 2025, distributing a total sum of N4.686 billion for the 5-year bond and N266.452 billion for the 9-year bond.

The auction revealed a substantial investor preference for the 9-year maturity, which cleared at 19.99%, while the 5-year bond experienced considerably diminished interest. The bond tender, conducted on March 24, 2025, involved the re-opening of the 19.30% FGN APR 2029 (5-year bond) and the 19.89% FGN MAY 2033 (9-year bond).

The auction registered significant investor engagement, particularly for the longer-dated bond. This information was disseminated via a statement posted on the agency’s official website this Monday.

Auction Results Summary

Key Observations from the Tender

The 5-year bond (19.30% FGN APR 2029) witnessed a relatively subdued subscription level, attracting bids totaling N59.069 billion against the N200 billion offered. Consequently, only N4.686 billion was allocated to successful bidders.

The 9-year bond (19.89% FGN MAY 2033) was oversubscribed, with total bids reaching N471.241 billion against the N100 billion offered. The DMO distributed N266.452 billion to successful bidders, illustrating a robust investor demand for extended-term government securities.

Non-competitive allotments were noteworthy, with N91.300 billion allocated for the 5-year bond and N61.150 billion for the 9-year bond.

The marginal rates settled at 19.00% for the 5-year bond and 19.99% for the 9-year bond, reflecting market assessments on interest rate trajectories.

DMO’s Stance on Coupon Rates

Notwithstanding the auction outcomes, the DMO reiterated that the original coupon rates for both bonds will be maintained:

- 19.30% for the 19.30% FGN APR 2029 bond

- 19.89% for the 19.89% FGN MAY 2033 bond

Market Implications

The strong demand for the 9-year bond suggests that investors are leaning towards longer-dated instruments, potentially in anticipation of stable or decreasing interest rates over the medium term. Conversely, the weaker demand for the 5-year bond may indicate caution regarding shorter-term yields or liquidity concerns within the fixed-income market.

Analysts posit that the results mirror broader macroeconomic trends, including inflationary pressures and monetary policy expectations. The marginal rates indicate that investors are factoring in potential risks while seeking attractive yields.

The March 2025 FGN bond tender displayed varied investor sentiment, with substantial interest in extended-tenor bonds but moderate participation in shorter-term securities.