Notwithstanding the biting effect of the COVID-19 pandemic, the internally generated revenue (IGR) of Lagos State grew to about N212.5 billion in the first seven months of 2020. This represents a 4.5 per cent or N9.1 billion increase, compared with N203.4 billion realised by the state in the first seven months of 2019.

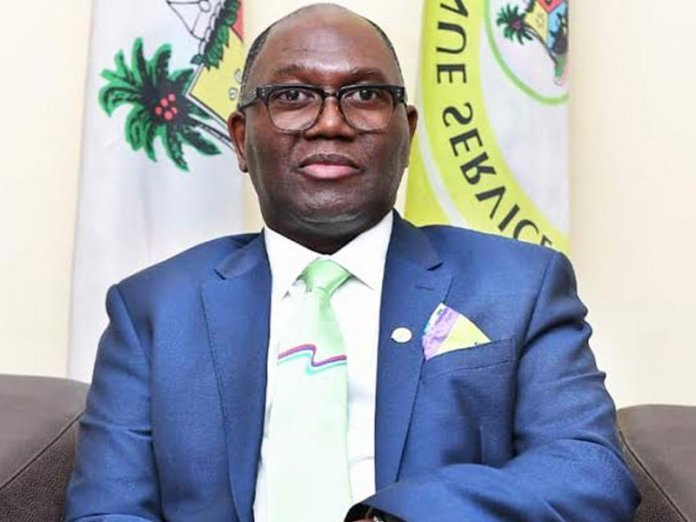

Executive Chairman of Lagos Internal Revenue Service (LIRS), Mr. Hamzat Subair, disclosed the latest revenue earning during an interview with THISDAY in Lagos.

Subair said in January the state generated about N34.5 billion; whereas the target for the month was N42 billion. The amount realised in January was the highest monthly revenue generated by the LIRS since its establishment, he revealed.

The LIRS chairman explained, “In the first place, the target was a tall order. But it was based on certain strategies and certain dependables that we had hoped to implement during the year. But just about when we were settling down to actually implement some of these measures, was when the pandemic came in. That N34.5 billion was an all-time high. The agency had never generated anything close to that.”

Subair disclosed that in February, the IGR was about N32.5 billion; around N32 billion in March; before it dropped to about N25.5 billion in April. In May and June, the state recorded a total IGR of about N28.5 billion each month, before it climbed to about N31 billion in July.

In addition to the total figure, Subair revealed, there was a one-off payment of N1.5 billion from the federal government, which represented outstanding Pay-As-You-Earn from some Ministries, Departments, and Agencies (MDAs).

The LIRS head explained, “So, you can see that with the measures fully kicking in and, of course, with the phased re-opening, things started to get better in July. So, it is on the upward trend based on all the measures that we put in place.

“You know with the pandemic, both the federal and Lagos State budgets had to be revised. So, the target in the Lagos State budget is N30 billion monthly, which is what is going to be looked at throughout the year.

“You can then say that making N34.5 billion is well above the budget and at the moment, the target is N30 billion. So, we are on track.”

Subair, however, stressed that the projections of the LIRS, just like other organisations across the world, were disrupted by COVID-19. He revealed that in the first quarter, following the announcement of the pandemic’s outbreak in the country, “we sat down at the LIRS and constituted a COVID-19 taskforce and this was born out of our initial design of a business continuity plan.”

He added, “We knew that sooner or later, there was going to be a lockdown and to try and mitigate the lockdown, we set up certain systems from the business continuity plan, which centred on the provision of digital services.

“Luckily, late last year, we had launched an end-to-end tax administration solution called e-Tax. What e-Tax does is that all taxation processes that you can think of would run through that platform.

“That means that taxpayers do not have to physically go to any of the LIRS locations, but can remotely access same types of services that they would come here for. So, we set that up and we made sure that we strengthened all the structures around that platform, to ensure that we operate optimally, even with the lockdown.

“The other digital platform that we strengthened was our contact centre – 0700 CALL LIRS. Now, we knew that during that lockdown, a lot of taxpayers would have a lot of enquiries from LIRS, based on their transactions with us.

“So, we had to make sure that we had a viable contact centre, even though there was lockdown. We even had to buy laptops and phones for the officers in the contact centre to use. We also had to provide internet connectivity in their homes.

“All these were just to ensure that all our remote services would continue to function effectively. So, with these two major platforms, we were able to keep the business of tax collection viable and active.”

Subair also revealed that during the lockdown, LIRS had a 100-man team selected for duties, who worked from home and meetings were held virtually. He said the revenue collection agency was working on an initiative to address concerns about multiple taxation in the state.

According to him, “Lagos is very conscious of multiple taxation. It might please you to note that at the state level, we are presently compiling a sort of revenue code, which is going to make sure that the taxes are known and that they are certain. This would be publicised state-wide. It would be on our website.

“We are hoping that we can achieve that before the end of this year. So, it is work-in-progress right now. It would help disabuse the minds of members of the public.

“In most of the climes, businessmen want to know all the tax liabilities that would come their way during the year. So, we don’t see any reason why we cannot achieve that. With Lagos being in the forefront, we want to achieve that this year.”

Source: THISDAY