In the first half (H1) of 2022, a total of 18 businesses operating in Nigeria and other African nations sent N330.9 billion to revenue agencies, a 35% increase from the N245.18 billion reported in the first half of 2021.

Corporate Income Tax (CIT), Education Tax, National Information Technology Development Agency Tax (NITDA), and Nigeria Police Trust Fund Levy are required to be paid by all businesses doing business in Nigeria.

The 30% CIT is a tax levied against businesses in Nigeria, and the amount is determined by the net profit the firm made from its operations. The federal, state, and local governments where these businesses operate rely heavily on the revenues from these businesses.

The National Bureau of Statistics (NBS) reports that N532.48 billion in total was remitted as CIT for the first quarter (Q1) 2022, an increase of 53.09 percent from N347.81 billion in the fourth (Q4) 2021.

According to information published on the Nigerian Exchange Limited (NGX), Dangote Cement Plc led all other companies in the payment of taxes to the governments where they do business, followed by MTN Nigeria Plc, Seplat Petroleum Plc, and Ecobank Transnational Incorporated (ETI).

The likes of Zenith Bank Plc and United Bank for Africa Plc, among others, have not yet made their audited half-year financial statements for the period ended June 30, 2022, available to the investing public as of the time of submitting this article.

The breakdown showed that Dangote Cement reported N92.79billion tax expenses in H1 2022, an increase of 3.5 per cent from N89.6billion reported in H1 2021, while MTN Nigeria’s announced about 18.7 per cent increase in tax expenses to N87.01billion in H1 2022 from N73.3billion reported in H1 2021.

The CEO, of MTN Nigeria, Karl Toriola in a statement explained that the tax paid was on investments in government securities following the expiration of the 10-year tax exemption period, and the education tax rate increased to 2.5 per cent.

However, Totalenergies Marketing Nigeria reported N4.2 billion in tax expenses in H1 2022, an increase of 13.22% from N3.7 billion reported in H1 2022, while Seplat Petroleum reported N51.85 billion in tax expenses in H1 2022 from N10.12 billion in H1 2021.

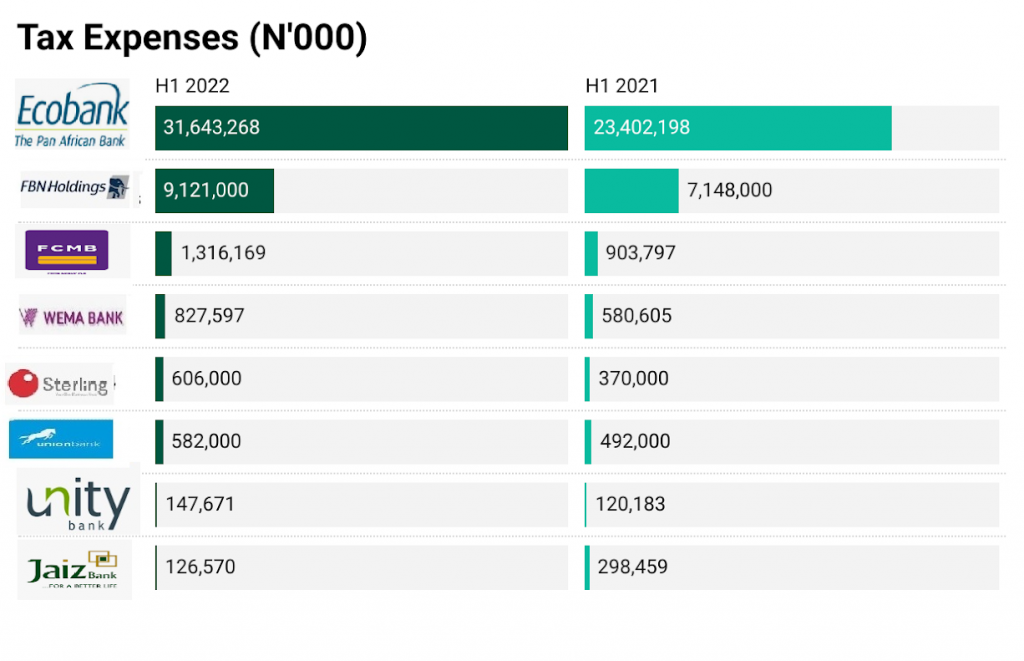

In the banking industry, ETI reported N13.75 billion in tax expenses in Q1 2022 compared to N10.34 billion in Q1 2021, and FBN Holdings reported N9.12 billion in tax expenses in H1 2022 compared to N7.15 billion in H1 2021 in its unaudited financial statement.

Experts had linked the rise in tax expenses to the unpaid taxes accrued by these businesses, while emphasizing that the period under review also saw a significant rise in profits.

Fiscal Policy Partner and Africa Tax Leader, at PwC, Mr Taiwo Oyedele attributed the hike in tax expenses by listed firms to payment of deferred tax liabilities. According to him, the tax expenses reported in H1 2022 are not the amount companies remitted due to deferred tax.

He explained further, “You will have to take into account that a company can always report N1billion as tax expenses but the amount remitted to FIRS, among other agencies might be N400 million.

He stated further that tax expenses differ by sector, adding, “Specifically, the banking sector has a different pattern from the manufacturing sector. The banking sector has a lot of tax exemptions including government bonds which those in the manufacturing sector are not enjoying.”

Oyedele noted that increasing tax expenses due to improved business activities in the country is good for the nation’s economy, stating that, “increasing tax expenses over government policies that seem to impose additional burden is not a welcome development. In the final quarter of 2021, one of the changes was increasing the education tax from two per cent to 2.5 per cent.