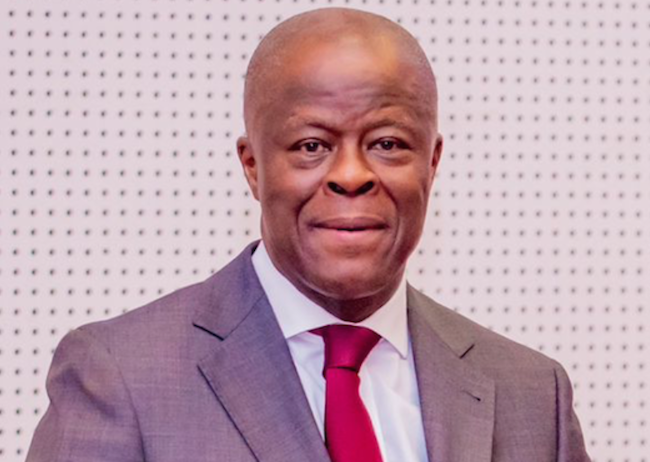

The Federal Executive Council (FEC) approves a $2.2 billion financing package to support the Federal Government’s external borrowing strategy. The announcement comes from the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, following a council meeting in Abuja.

Key Details of the Borrowing Plan

The approved funding includes access to the international capital market through a mix of Eurobonds and Sukuk bonds. The breakdown of the plan consists of approximately $1.7 billion in Eurobonds and an additional $500 million in Sukuk financing. Edun states that the government is awaiting approval from the National Assembly, after which the borrowing will proceed quickly, likely within this fiscal year.

“The next step is to present the borrowing plan to the National Assembly for approval. Once granted, we aim to proceed with the issuance this year,” Edun says.

Financing Strategy Dependent on Market Conditions

The final mix of financing instruments depends on prevailing market conditions and recommendations from financial advisors at the time of issuance. Edun notes that the government’s decision to use Eurobonds and Sukuk bonds is part of a broader strategy to optimize Nigeria’s access to global financial markets.

He highlights the resilience of the Nigerian financial markets, citing the success of recent domestic dollar bond issuances as evidence of market confidence. “Earlier this year, we demonstrated the strength of Nigeria’s financial markets with a successful issuance of dollar bonds, showcasing investor confidence in the nation’s economic policies under President Bola Tinubu’s administration,” Edun says.

Real Estate Investment Fund Launched to Address Housing Deficit

Alongside the borrowing plan, the FEC approves the establishment of the Morph Real Estate Investment Fund, a N250 billion initiative aimed at tackling Nigeria’s housing shortfall. The fund is designed to provide long-term, low-cost mortgages, helping reduce the country’s significant housing deficit, currently estimated at 22 million units.

“This fund will support Nigerians seeking affordable housing and is expected to partially address the existing housing deficit,” Edun says. The initiative is part of a broader effort to boost the housing sector, generate employment, and stimulate economic growth.

The fund will also attract private-sector investment in housing development, offering long-term investors competitive returns. “Private-sector investors will have the opportunity to earn market-rate returns, backed by an initial seed funding of N150 billion,” Edun adds.

Economic Impact

These financial measures are part of the Federal Government’s strategy to support economic recovery, expand infrastructure, and foster sustainable development. The combination of external borrowing and the newly established real estate fund is expected to drive economic growth, create jobs, and improve access to affordable housing across Nigeria.