Short of cash for the festive period? There is no reason to despair, yet, as there are many quick loans you can access within the shortest period as N-Power beneficiaries.

The chances of survival in the year 2020 have been very tough, especially for those who live in third world countries like Nigeria.

Due to COVID-19 pandemic and #ENDSARS protest, Nigeria slides into the second recession in five years as the inflation rates increased, currently at 14.89% as at November 2020, National Bureau of Statistics reveals.

Bizwatch Nigeria brings you a list of urgent loans N-Power beneficiaries can apply for;

Carbon

N-Power beneficiaries can obtain a loan without unworkable collateral.

Beneficiaries can get a loan through their phone by just downloading the Carbon app.

The loan opportunity is available for 24-hours every day, and within five minutes, you can get the loan or funds in your account. Carbon offers as much as NGN1 million.

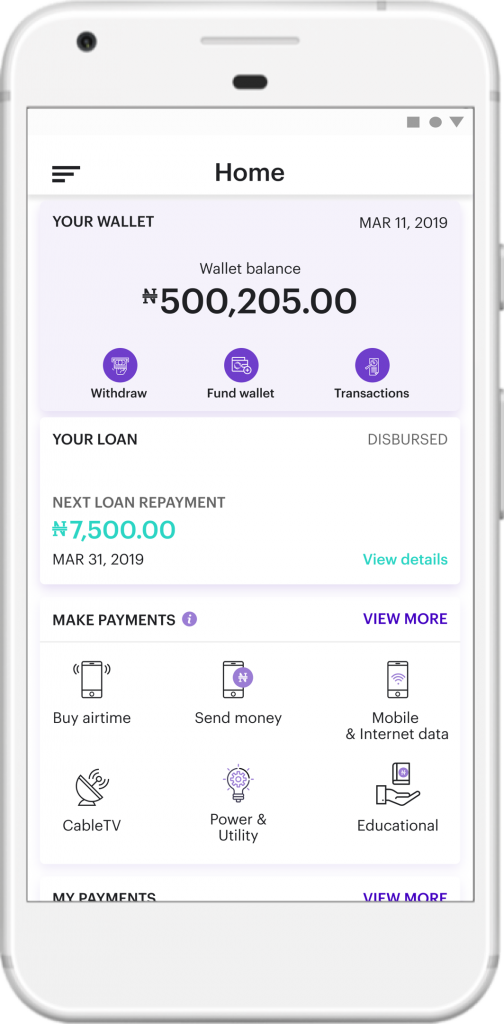

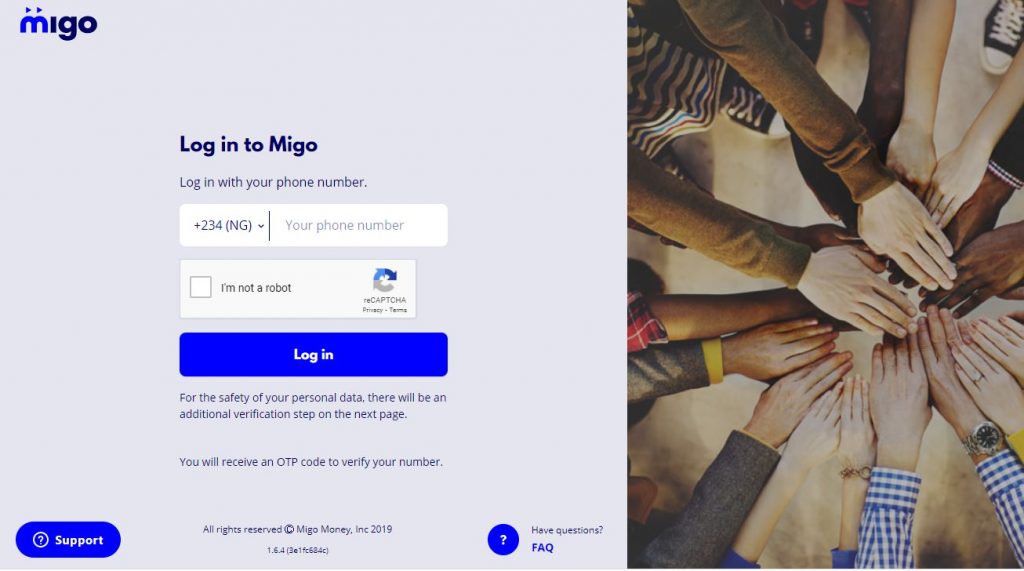

Migo

This is another quick loan N-Power can also access within five minutes.

Applicants need to fill loan application on the Migo website or mobile app, enter the phone number and the One-Time-Password (OTP) sent to your phone.

Migo have several loan offers that Npower beneficiaries can choose from depending on your credit or amount needed. Migo also offers loan within five minutes, faster than most banks, at range of NGN500 to over NGN500,000.

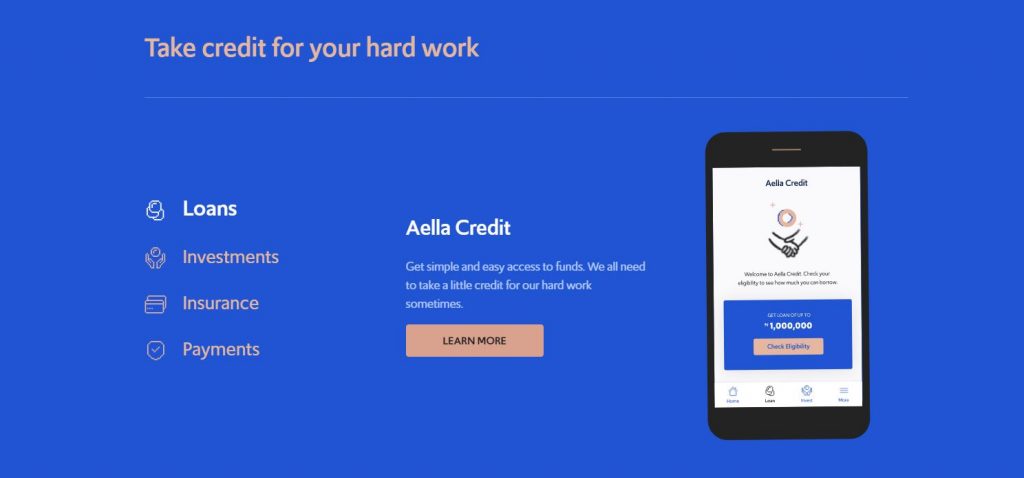

Aella

Gone are the days getting loans in Nigeria can be very hectic as Aella loan app makes it very easy getting instant loans.

All you need to do is just your mobile phone to access the loan.

Aella offers up to NGN1 million in five minutes at different interest rates with charging for late or rollover fees. To access Aella’s loan, all Npower beneficiaries need to do is simple; download Aella app, fill your details, check eligibility for available loan, and you get your requested loan.

GTBank Provides N-Power Urgent Loans

This is the most popular loan app among Fintechs and commercial banks. This is because the GTBank Quick loan provides credit with the smallest interest rate in Nigeria – 1.75%.

Unlike the typical bank loan process, GTBank offers its salary account holders loan through phone without having to visit any of their bank branch. You can access this loan through USSD code (73751*51#) or GTBank mobile app and obtain as much as NGN5 million or as low as NGN10,000.

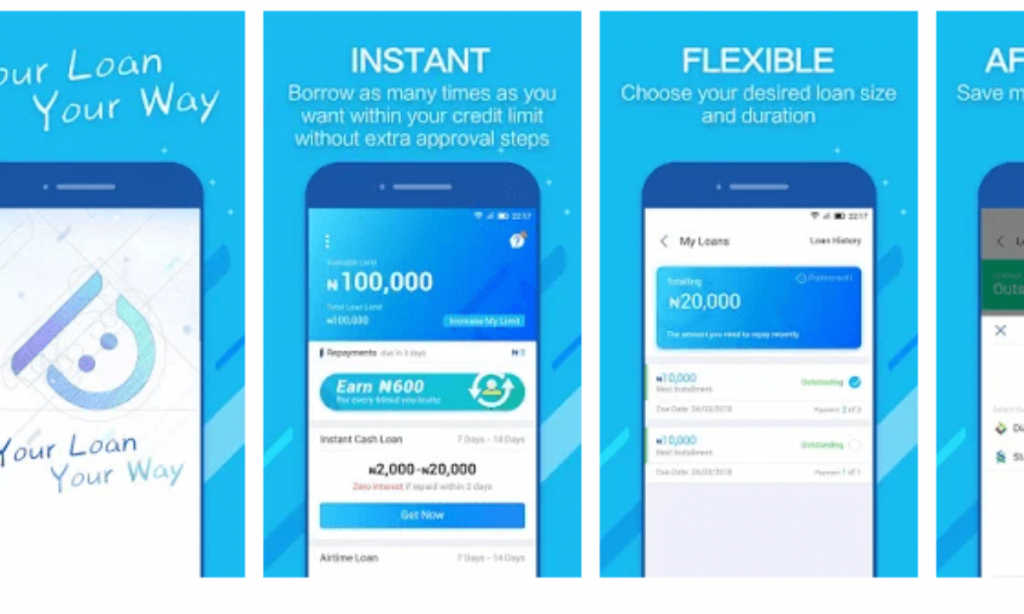

Palmcredit

Another instant loan that N-Power beneficiaries can take advantage of is Palmcredit. The loan company offers as low as NGN2000 and as high as NGN100,000. within minutes as well. You also get the loan by applying directly from your phone or mobile app.

Another good thing about Palmcredit is that if you pay back your loan within 24hours after collating the loan, Palmcredit will reward you with cash.

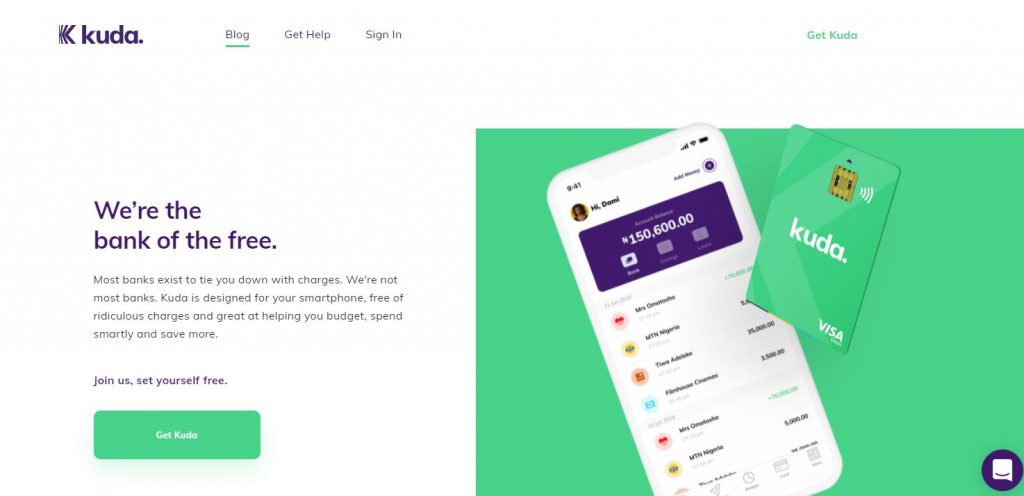

Kuda Bank

Kuda isn’t like any other bank you see on the street. Kuda uses savings to invest in risk-free investment options, and offer its users a 15% interest rate annually. By saving on Kuda, N-Power beneficiaries can qualify for quick loans.

Just like other investment platforms, Kuda doesn’t charge for maintenance, ATM withdrawals with a card, or financial alerts. Kuda Bank is a growing investment platform that has been downloaded over 100,000 times by users.