South Africa’s newest bank – which is entirely app-driven on smartphones – has begun testing its new services with staff ahead of its expected public launch next year.

Called Bank Zero, it has been the subject of intense speculation because its founders are all senior bankers from First National Bank, one of the major financial institutions in Africa. The name is a hint about it won’t charge fees. It will go live in mid-2019.

“WhatsApp, Facebook and Twitter do not have a branch infrastructure, nor call centers, nor do they require extensive paperwork to be signed to join them. If banking were to be developed from first principles it would be like these popular Apps and be smartphone-based, which is exactly what Bank Zero will do,” co-founder and chairman Michael Jordaan told me. “Competition is an essential part of any market economy as it keeps existing players on their toes. We believe that banking fees for electronic transactions and card swipes are way too high in SA and want to compete those away. Ultimately the consumer will win.”

Bank Zero Mutual Bank, which says it is more than 45% black-owned and 20% women-owned, began alpha testing with its staff this month and will be hosted by IBM on its open-source based LinuxONE enterprise server. A credit card will be offered via Mastercard. As a mutual bank, it won’t offer loans but will promote savings.

Earlier this year a McKinsey Global Banking report described banking in Africa as “among the most exciting in the world” and “a hotbed of innovation”. With 40% of Africans preferring to use digital channels for transactions, it said the retail banking sector is “a locus of new business models, emerging in response to challenges including low levels of banking penetration, heavy use of cash, sparse credit bureau coverage, and limited branch and ATM networks”.

Being an app-based bank is a radical departure. “There is a difference between a bank with an app and an app-driven bank,” Jordaan told me. “Bank Zero will offer all services through the app whilst other banks tend to offer their app as an additional channel.”

Typically, such an “additional channel” app will not have all banking functionality available, still forcing customers into the branch or onto the internet for things like closing an account, replacing a card, or verifying their identity. “This is because existing processes typically demand manual interventions and complex user interfaces, being built on legacy systems. Trying to retrofit these processes to a newly added app is difficult (and in some cases impossible). This explains why banks are starting to spend billions replacing their legacy systems in support of such new channels.”

He adds: “In an app-driven bank like Bank Zero all our functionality is designed with our app in mind. Our core banking platform also directly supports our app.”

Unlike many fintech start-ups who partner with a sponsoring bank to use their banking licence, Bank Zero has spent a year and a half going through the stringent process of registering as a bank with the South African Reserve Bank (SARB)

It was granted a formal licence in August by SARB, which oversees all financial service providers, and successfully integrating its back-end systems with the national payments systems during September.

“The approval process, from submission to final license, has taken 18 months. The Prudential Authority that is part of the Reserve Bank has very high standards and has actually added value to our risk management capabilities and policies. We now have the privilege to integrate into the national payments systems and transact with the big banks as a peer. We intend using this privilege to lower the cost of transactional banking for our customers.”

Jordaan says they partnered with IBM “as we wanted a very high level of encryption as well as the ability to scale fast. But the real saving comes from using the latest software and then using proven open-source code. We do not have to support legacy systems and can use reliable software that is accessible for free to create a revolutionary new banking system.”

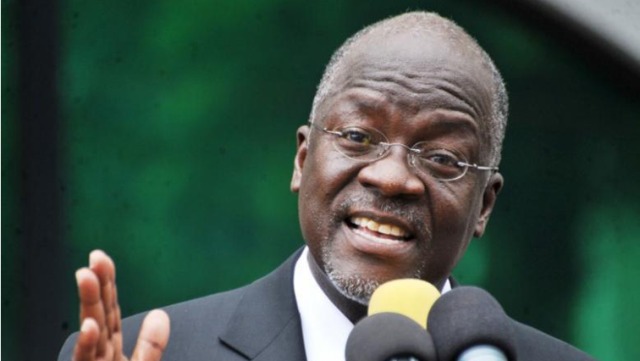

Jordaan is an unusual celebrity in South Africa. He was only 30 when he was made the CEO of one of South Africa’s big four banks, First National Bank, which he ushered into the digital era, including launching the country’s first smartphone banking app in 2011. When he resigned after years of weekly commutes, he returned to his home in Stellenbosch, a town outside Cape Town that is renowned for its wine production and is the base of several major investors. Jordaan is now a venture capitalist, with investments in a number of tech start-ups, including a data-only cellular network that recently announced it would invest in a 5G network.

His new banking venture is being closely watched a number of new banks are set to enter a market that has traditionally been dominated by four major banks. A low-cost upstart that launch in 2001 called Capitec addressed the lower end of the market, and has rapidly grown its market share.

Discovery Health, the country’s largest medical insurer, is poised to launch its own bank – having diversified into life, car and household insurance, as well as offering a credit card and other financial services. A major announcement is scheduled for next week.

Another new bank that is attracting a lot of interest is TymeDigital, which was launched a few years ago and provided the backend of MTN Money, the mobile payment service offered by Africa’s largest cellular network.

It was bought by Commonwealth Bank of Australia, which this year sold its stake to African Rainbow Capital – the investment holding firm of South Africa’s richest man, Patrice Motsepe.

Sandile Shabalala, the CEO of TymeBank, as it will be renamed, says alpha testing with staff has begun. “We’re almost there in terms of launching the bank. There’s some regulatory stuff to get through,” he told me. “For now the one thing we are working on is to finalise the transaction with Patrice Motsepe. We have been through the Competition Commission. We’ve been through the prudential authority. The last thing we are waiting for is the approval from the finance minister. Then we can start thinking about timelines for the launching of the bank.”