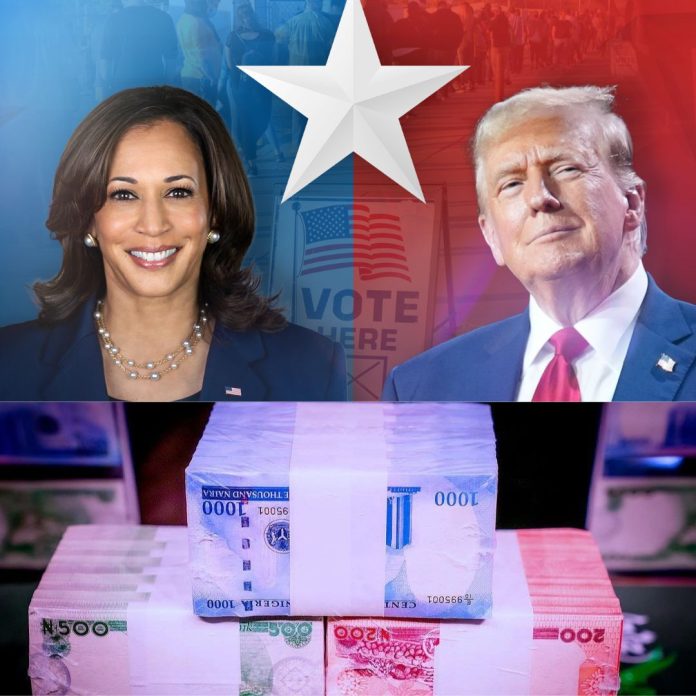

The naira is under intense pressure since the Tinubu administration adopted an FX floating regime, while the US grapples with its own political and economic challenges. Since June last year, the naira has depreciated by around 70% against the dollar.

The Nigerian government aimed to attract foreign capital, enhance investment appeal, and reduce foreign exchange spending on currency defense through its devaluation strategy. However, the immediate effects have been significant: inflation has hit a 30-year high, disposable incomes have dropped to record lows, and social unrest and crime have risen.

In the black market, naira short sellers are firmly holding the N1,600 support level, and demand for foreign currency remains high due to travel, fuel imports, and overseas tuition. Fitch Ratings projects the naira to close the year at N1,450 per dollar.

The US presidential election could further influence the naira through several interconnected channels:

Economic Policies

A US president pushing for tariffs or protectionist policies, such as those proposed by Donald Trump, could strengthen the dollar, putting the naira under additional pressure. If the US implements trade tariffs, especially on major economies like China, this could trigger global economic shifts that might lead to a stronger dollar, weakening the naira.

Oil Prices

Nigeria’s economy depends heavily on oil exports, and US policies on energy production and sanctions can impact global oil prices. If a Trump administration pursues energy independence and increases domestic production, it may keep oil prices low, negatively affecting Nigeria’s oil revenue and, consequently, the naira.

Foreign Investment and Capital Flows

The election outcome could influence global capital flows. A Kamala Harris administration might be perceived as more business-friendly, potentially increasing US investment in emerging markets like Nigeria and providing some support to the naira.

Interest Rates and Monetary Policy

US Federal Reserve policies, driven by the administration’s economic stance, could increase US interest rates, attracting capital to the US and strengthening the dollar. Trump’s vocal criticism of Fed Chair Jerome Powell and potential plans to advocate for more stimulus could, however, give the naira some temporary respite if the dollar weakens due to fiscal measures.

Geopolitical Stability

The US president’s approach to international relations, especially regarding conflicts or trade tensions, can affect investor confidence. A Kamala Harris administration could prioritize stability, reinforcing global institutions such as the World Bank and IMF, where Nigeria seeks support for its foreign obligations. On the other hand, anticipated Trump policies, including high tariffs, might bolster the dollar, exacerbating the naira’s depreciation.

The election’s outcome will indeed have implications for the naira, but other factors like Nigeria’s internal policies, global economic conditions, and unexpected geopolitical events will also shape its future. Even if Trump wins, a negative global reaction to his policies or an economic downturn could limit dollar gains against the naira. Conversely, another administration might stabilize the US economy without a severe impact on global trade, which may be less damaging to the naira.

In essence, while the US presidential election will influence the naira’s value, the scope of this impact depends on a range of complex global and domestic dynamics that go beyond the US administration’s policy decisions alone.