The long-anticipated student loan program will officially commence this Friday, benefiting 1.2 million students in federal tertiary institutions across Nigeria, according to Akintunde Sawyerr, Managing Director/CEO of the Nigeria Education Loan Fund.

Speaking at a pre-application sensitization press conference in Abuja on Monday, Sawyerr announced that students from federal universities, polytechnics, colleges of education, and technical colleges will be the initial beneficiaries.

Data from the National Universities Commission shows Nigeria has 226 federal tertiary institutions, including 62 universities, 41 polytechnics, 96 monotechnics, and 27 colleges of education.

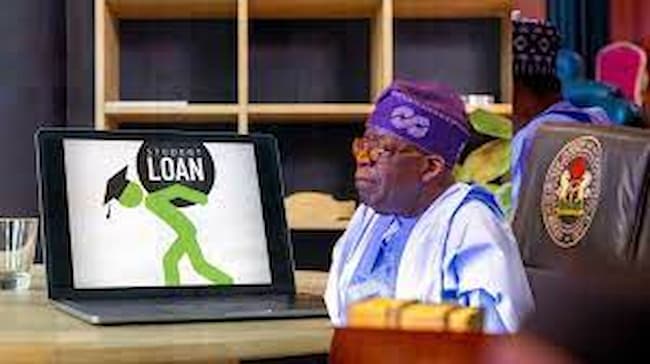

President Bola Tinubu signed the Student Loans (Access to Higher Education) Act (Repeal and Re-Enactment) Bill, 2024, into law on April 3. This act replaces the Student Loan Act, 2023, and establishes the Nigerian Education Loan Fund to manage and disburse loans to students for higher education, vocational training, and skills acquisition.

The new law removes the family income threshold, allowing more students to apply for loans and take responsibility for repayment according to the Fund’s guidelines.

Speaking at the signing, President Tinubu emphasized the importance of accessible education for all Nigerians. “No one, no matter how poor their background is, should be excluded from quality education and the opportunity to build their future,” he said.

The program faced initial delays, originally set to launch in September but postponed due to the expansion of the scheme to include vocational skills loans. Last Thursday, the Nigeria Education Loan Fund announced May 24 as the official date for opening the loan application portal.

Sawyerr urged students in federal institutions to visit www.nelf.gov.ng from May 24 to apply. Students from state universities and vocational skills centers can apply at a later date. The requirements include an admission letter from the Joint Admissions and Matriculation Board, National Identity Number, Bank Verification Number, and a completed application form from the website.

He highlighted that the application process is streamlined for easy access, with online support available for applicants. Sawyerr also noted that the absence of physical contact between applicants and NELFUND is a key feature of the program, with the portal designed to be user-friendly.

Applicants will receive not only interest-free loans but also monthly stipends for upkeep. However, the specific amounts were not disclosed, as they will be determined based on several factors and capped accordingly.

The loans will be disbursed directly to institutions to cover tuition and fees per session, ensuring accountability. Institutions are responsible for providing the Fund with data on fees payable by students at various levels.

Sawyerr assured that security measures are in place to prevent fraud, and he encouraged students to apply promptly to ensure timely processing of their applications.

In a related development, the Federal Government has urged state governments to use the matching grants allocated for the Universal Basic Education Commission program responsibly. UBEC Executive Secretary Dr. Hamid Bobboyi stressed the importance of integrity and adherence to financial regulations during a training program for accountants and auditors.

Bobboyi emphasized the need for a robust accounting system to manage the Federal Government’s UBE Intervention Fund effectively. He highlighted that continuous professional development is necessary to improve financial practices and ensure accountability.

Despite previous training efforts, Bobboyi lamented the limited improvement in financial practices, citing poor record-keeping and infractions revealed by UBEC’s quarterly financial monitoring. He called on financial officers to adhere strictly to government guidelines to maintain transparency in financial transactions.

The training program aims to equip financial officers with the necessary skills to manage the UBE Intervention Funds responsibly, with a new sanction regime approved to enforce compliance.

“We expect that by the end of this training, financial officers will be better prepared to manage the funds responsibly, adhering to financial regulations and due process,” concluded Adamu Misau, UBEC’s Director of Finance and Accounts.