Interswitch, Africa’s leading integrated payments and digital commerce company, has restated its commitment to empowering and supporting the development of the Product community in Nigeria.

This outlook was reiterated by the fintech giant’s sponsorship of The Dive 2023, a Product Leadership Conference organized by the Product Management Community, Product Dive.

The conference, which was held at Zone Tech Park, Gbagada, Lagos on August 12, 2023, proved to be an invaluable platform for the exchange of ideas, insights, and strategies that will undoubtedly shape the future of product leadership in Nigeria and beyond.

It brought together Product Managers, Heads of Product, start-up founders and ambitious leaders from various industries to enrich their expertise, forge connections, and ignite innovation within their organizations.

Speakers and facilitators at the conference included Ebi Atawodi, the Director of Product at Google, who delivered the keynote; Nnanna Enyi, Principal Product Manager at Amazon (and ex-Interswitch) and Bunmi Ayeh, Product Lead at Meta.

Through this partnership with Product Dive, Interswitch sustains its ongoing support for the Product community as part of its commitment to foster development in the tech ecosystem.

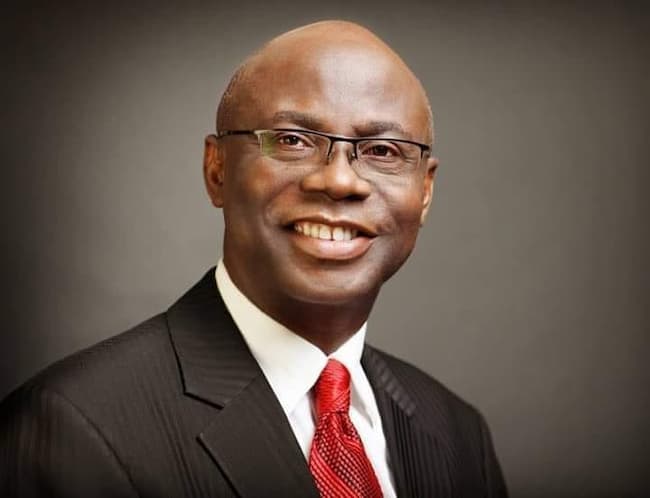

Commenting on the essence of the event and Interswitch’s partnership with the event organizers, Tomi Ogunlesi, Group Head, Brands and Communications at Interswitch, noted that the company remains committed to identifying and nurturing platforms that will drive the growth of product professionals and tech talent as a whole.

He said, “Our support for The Dive 2023 aligns with our pursuit of empowering the tech community and reflects our belief in the transformative potential of collaboration and skill development. We are resolute in our mission to contribute to a thriving ecosystem where innovation and expertise intersect harmoniously.”

Interswitch’s engagement with The Dive 2023 is just a glimpse its sustained dedication to the product community.

Building upon the success of The Dive 2023, Interswitch is poised to make yet another substantial contribution to the Product industry as the headline sponsor for the upcoming Inspire Africa Product Conference, scheduled to take place in September 2023 in partnership with the renowned Silicon Valley Product Group (SVPG), affirming its commitment to catalyzing positive change and growth within the tech industry.

With Interswitch’s continued support, the firm is not only solidifying its position as a market leader but also nurturing an ecosystem that fosters innovation, collaboration, and excellence, demonstrating its holistic approach to driving industry growth and elevating product professionals across the continent.