Further robust expansions in output and new orders helped drive a pick-up in growth in the Nigerian private sector during November.

However, private sector performance was overshadowed by a record increase in overall costs amid ongoing global supply issues and unfavourable exchange rate movements. Firms were nevertheless committed to raising their inventory holdings in a bid to protect against future shortages and price hikes.

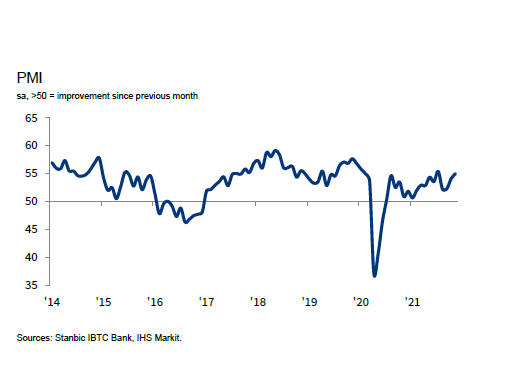

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI®). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

At 55.0 in November, up from 54.1 in October, the headline PMI signalled a solid expansion in business conditions,

bringing the sequence of growth to 17 months. Central to the improvement was the joint-fastest rise in new orders for almost two years. Higher sales to both international and domestic markets, as well as greater client requirements, underpinned growth.

Subsequently, output increased for the twelfth month running and at a quicker pace. Sub-sector data revealed expansions across the board, although manufacturers recorded by far the strongest increase. Wholesale & retail,

agriculture and services followed, respectively.

With workloads increasing, firms looked to fill vacant positions. Job creation has now been recorded in each of the last ten months, with the latest expansion only modest but above the average seen for 2021 so far.

As a result, firms were able to keep up with demand resulting in an eighteenth consecutive monthly decline in backlogs. The reduction was marked and amongst the steepest in the series history. Improving vendor performance also helped keep backlogs at bay in November.

Turning to prices, global supply shortages for a range of raw materials, unfavourable dollar-naira exchange rate movements and increasing staff costs led to a record rate of overall input price inflation. Firms chose to pass on a large

part of the burden to clients, with selling price inflation also picking up to a fresh new series high.

Despite rising cost pressures, firms continued buying activity and added to their inventory holdings as they sought to protect against future shortages. In fact, stocks of purchases rose at the fourth-most marked rate in the series history.

Business sentiment remained positive in November, fuelled by plans to broaden product offerings. However, the degree of optimism moderated to a three-month low and posted below the average for 2021 so far suggesting that longer-term concerns surrounding COVID-19 persist.