All good things in life they said start with little effort from great minds who are willing to make a difference and most time sacrifice their time, money and other valuables to achieve their goals.

Despite the current state of Nigeria economy, some are now surviving the situation on their wise decision to have invested wisely during the rainy season.

Bizwatch Nigeria gathered the MTN Nigeria has opened the door of opportunities to many Nigerians to become shareholders with one of the biggest telecommunication firms in the country.

MTN Group will sell up to 575 million shares in MTN Nigeria to retail investors in a public offering priced at N169.00 per share (the Offer).

MTN Shares Closing Date

The Offer will begin on Wednesday, December 1st, 2021 and end on Tuesday, December 14th, 2021.

Simple Ways To Buy MTN Shares On Phone

If you want to become one of MTN’s shareholders, follow the steps below to buy with as low as N3,380 on your phone.

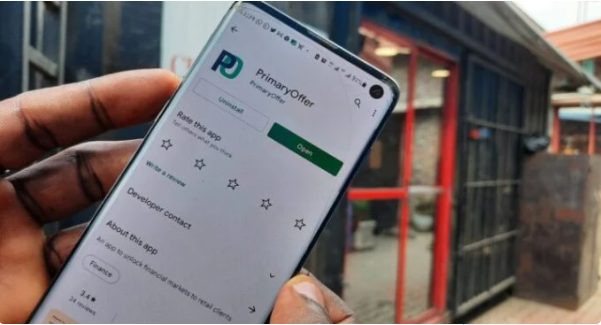

- Start with an app: For this process, you would need a smartphone. Go to your phone’s app store. www.primaryofferng.com

- Set up an account: Create an account using your bank verification number and date of birth. Here, you’d also need to set up your password, which should be kept as privately as possible. Once this is done, the app, would already have some of your details, showing that it is somewhat connected to the banking system.

- Validate your account: After setting up your account, you will be asked to enter your security code. That code is in an email you already received. It is a one-time password (OTP), which you will type into the app to validate your account.

- Login and begin: Once your account is all set up, you’d get a congratulatory message on your screen. The message would also have a blue button, asking you to login to the app. Enter your email and recently created password to get into the dashboard. Once you’re in, click on MTN Nigeria offer.

- Terms and Purchase: Once you click on MTN Nigeria offer, you’d see the terms and condition page, read and accept by ticking the unchecked column near the purchase button. Once you do that, click on purchase.

- Choose a number of shares: Your latest screen should now be showing “Enter your transaction details”. In the column for specified units, enter the number of units you want to buy. The minimum number of shares you can buy is 20.

Pay now: After choosing the number of shares, and checking the terms and condition box, you click on “pay now”. The app asks if you have a CSCS account. A Central Securities Clearing System (CSCS) account is a financial infrastructure for clearing, storing, and settlement of securities transactions. It is where all your shares are domiciled.

- Pay with card or USSD or transfer: When you get to this page, you have many payment options, choose which one works for you — bank transfer or card payment or just USSD — and pay for the shares. Please note that bank charges will be added, bringing your N3,380 to N3,418.

- Share allotment: Once payment is made, you would get a mail, stating the details of your payment and confirming receipt of the payments. Following approval by SEC, your shares would be allotted in less than 15 days. Going with these steps, you easily become an MTN shareholder.

Other Ways To Buy MTN shares?

B. Receiving Agents – Apply for your shares through authorised Receiving Agents – Issuing Houses, Stockbrokers & Banks (applications can be completed and submitted, and payments processed at bank branches nationwide).

- An interested investor should complete an Application Form.

- Submit the completed Application Form and make payment to a Receiving Agent.

- Receiving Agent confirms receipt of payment for the number of shares applied for.

- Receiving Agent issues an acknowledgement copy of the Application Form.

- Receiving Agent submits the application on PrimaryOffer.

- Applicant receives a notification from PrimaryOffer once the application is submitted by the Receiving Agent.

Requirement And Eligibility

Anyone above 18 years of age is eligible to buy the MTN shares on offer, but there are a limited number of conditions.

Applicants must apply for a minimum of 20 shares and multiples of 20 shares thereafter.

Applicants must have a valid BVN to register and submit an application on PrimaryOffer.

Applicants must have a CHN and CSCS account.