The Federal Government of Nigeria is set to repay about ₦1.03 trillion in domestic bond maturities on January 22, 2026, marking one of the largest single-month redemptions in the local debt market.

According to analysts at FMDQ Securities Exchange’s research arm, FMDA Research, nearly 40 per cent of the Federal Government of Nigeria (FGN) bonds maturing this week are concentrated in the 12.50 per cent FGN January 2026 bond, which falls due on January 22.

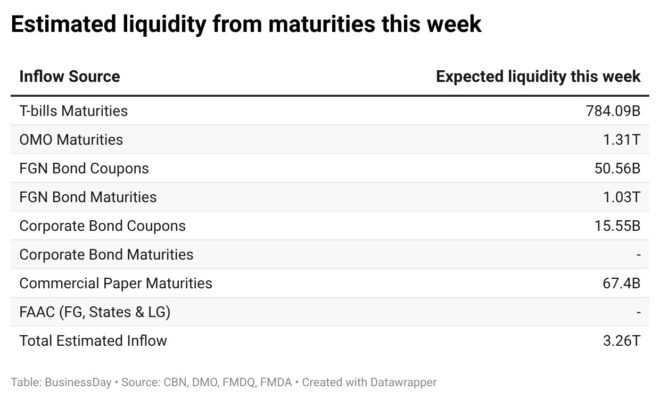

In its weekly market report, FMDA Research noted that the size and concentration of the inflows could influence short-term market dynamics, particularly investor behaviour and foreign exchange demand.

“Market participants should closely monitor reinvestment patterns, as the size and concentration of inflows could elevate foreign exchange demand and exert short-term pressure on the naira,” the analysts said.

Debt Profile Provides Context for Large Maturities

The repayment comes against the backdrop of Nigeria’s expanding public debt stock. Data from the 2026–2028 Medium-Term Expenditure Framework (MTEF) show that total public debt stood at $94.2 billion as of December 31, 2024, with external and domestic debt accounting for 48.5 per cent and 51.4 per cent respectively.

By the end of the first quarter of 2025, total public debt had increased to $97.2 billion, driven largely by higher domestic borrowing.

In naira terms, total public debt rose sharply to ₦149.3 trillion as of March 31, 2025, reflecting the combined effects of currency depreciation and additional borrowing. Domestic debt accounted for ₦51.2 trillion, while external obligations stood at ₦45.9 trillion, including the debts of state governments and the Federal Capital Territory.

The Federal Government remains the dominant borrower, underscoring the central role of domestic bond issuances in Nigeria’s financing strategy.

While the MTEF underscores the government’s preference for concessional external financing, domestic debt instruments continue to play a pivotal role in funding fiscal operations. These include FGN Bonds and Treasury Bills, as well as alternative instruments such as Savings Bonds, Sukuk, Green Bonds and Promissory Notes, all issued under the supervision of the Debt Management Office (DMO).

This growing reliance on domestic debt means that large bond maturities, such as the ₦1.03 trillion January repayment, carry important refinancing and liquidity implications. Analysts warn that if reinvestment appetite is weak, excess liquidity could spill into the foreign exchange market, potentially intensifying short-term pressure on the naira.

Despite ongoing efforts to improve debt sustainability, fiscal space remains constrained. The MTEF shows that debt service costs reached ₦13.12 trillion in 2024, representing 46 per cent of total Federal Government expenditure and 77.5 per cent of government revenues.

This highlights why large domestic bond maturities matter beyond the immediate cash outflow. Without significant improvements in domestic revenue mobilisation, rollover risks are likely to persist, limiting the government’s ability to scale investment in critical sectors such as infrastructure, healthcare and education.

While the January bond redemption is considered manageable, its scale and concentration underscore Nigeria’s increasing dependence on domestic debt markets. How investors choose to reinvest the ₦1.03 trillion will be critical in shaping liquidity conditions, foreign exchange stability and short-term yield movements in the weeks ahead.