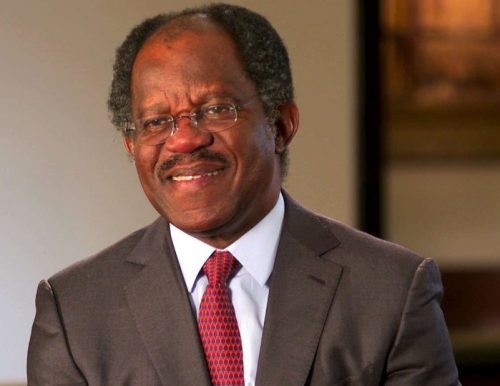

In a significant move, BlackRock, the world’s largest asset management company, has announced its acquisition of Global Infrastructure Partners (GIP), a firm founded by Nigerian investment banker Adebayo Ogunlesi, in a deal valued at $12.5 billion.

As reported by Arbiterz, BlackRock will pay $3 billion in cash and offer 12 million shares in BlackRock to Ogunlesi and five other co-founders of GIP. This transaction will make them the second-largest shareholders in the global asset management giant.

GIP currently has $106 billion invested in infrastructure, while BlackRock manages a staggering $10 trillion worth of alternative assets. Adebayo Ogunlesi, an alumnus of King’s College Lagos and Harvard University, previously served as the chief client officer and vice chairman at Credit Suisse First Boston before founding Global Infrastructure Partners.

Noteworthy assets under GIP, where Ogunlesi is chairman, include Sydney, the Port of Melbourne, the Suez Water group, extensive green energy holdings, and a stake in a significant shale oil pipeline. GIP gained prominence in Nigeria after acquiring Gatwick Airport.

The investment in infrastructure is categorized as an “alternative asset” class for traditional money managers like BlackRock. With this acquisition, BlackRock becomes the second-largest private investor and manager of infrastructure globally.

Adebayo Ogunlesi has stated that a portion of the cash and shares from the deal will be distributed to Global Infrastructure Partners’ 400 employees.

Ogunlesi’s success in the realm of global private infrastructure management has sparked discussions about Nigeria’s infrastructure deficit and the country’s need for policies and incentives to tap into the world of private infrastructure investment.

Despite Nigeria’s Bureau of Public Infrastructure and the Nigerian Infrastructure Concession Regulatory Commission overseeing private investment in infrastructure, major successful deals have been scarce for over a decade.