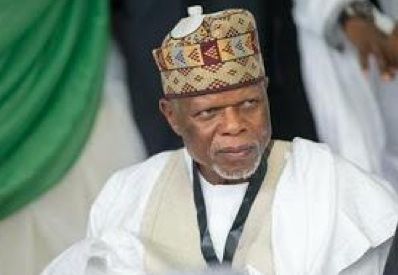

Car dealers and clearing and freight forwarding agents have hailed the call by the Comptroller-General of Customs, Hameed Ali, seeking a reduction in tariff on vehicles imported into the country.

Ali had last week called on the Federal Government to reduce the 35 per cent levy on imported vehicles so as to check the rising cases of smuggled vehicles into the country.

Ali who spoke during the unveiling of a Strategic Revenue Growth Initiative which held at the Ministry of Finance stated that vehicles imported into the country attract an import duty of 35 per cent and an additional levy of 35 per cent, bringing the total duty payable to 70 per cent, which he said was too high and fuelling smuggling.

“The 35 per cent is a baseline which is the duty, but the 35 per cent levy is what we think should be tinkered with. We should be able to reduce that to a level that it would be affordable. 70 per cent is on the high side, there is no doubt about that for new vehicles but we cannot touch the baseline of the tax regime,” Ali had stated.

Stakeholders, who spoke in separate interviews with SHIPS & PORTS DAILY, described the call as a welcome development saying it is high time the government listens to the plights of Nigerians especially those in the auto business.

President-General, United Berger Motor Dealers Association, Metche Nnadiekwe, lamented the lull in business since the government introduced 70 percent duty rate on imported vehicles.

Nnadiekwe who commended the Customs boss for calling for an urgent review of the tariff, said the high duty rate on imported vehicles has caused untold hardship to car dealers as most of them have been put out of business.

According to him, “The high duty on imported vehicles has messed up a lot of things. The business has never been the way it used to be after the government introduced the tariff.

“God bless the CG for realising that the duty is too high and the earlier the government realises the need to reduce it, the better. When government is talking about policies, they should talk to those who are in the sector and know areas it will affect them but the ‘I don’t care’ attitude of government to business people is what I don’t understand.

“They don’t know how the people are going to feel, they just wake up and introduce policies. The people are suffering and there is hunger in the land. So they just have to reduce the tariff.

“When you use such a huge amount to clear vehicle, how much do you want to sell it yet we are talking about fighting corruption? When somebody brings goods and Customs give high tariff, and he couldn’t get the money to clear it, he will be forced to go and commit himself into fraudulent acts to clear his goods because he would not want to abandon his goods in the port.

“Again, if the government had opened the border and make it compulsory that any good coming from there will pay a particular duty rate, with full security checks in place, the government will generate more revenue than it is losing due to smuggling. The government did not think twice before closing the border.”

President General, Association of Igbo Maritime Practitioners in Nigeria (ASIMPIN), Eze Damien Obianigwe said the call by the Comptroller General showed he has a listening ear to the concerns of the importers and their agents even as he expressed hope that government approves the request.

Obianigwe said if government could reduce the tariff, it would help improve its revenue base as importers would be willing to pay the duty rather than go through the risk of smuggling.

“We hope the government approves the request because it is a good move that will help reduce smuggling. That shows the Comptroller General of customs knows what he is doing and he is a listening leader. Importers have been complaining about high duty rate on imported vehicles and yet the vehicles are still smuggled in without duty payment making Government lose in both ways. If we reduce tariff, no importer will be willing to smuggle,” he said.

A frontline clearing agents, Ken Okoro added, “We have advised customs on this matter severally. New vehicles coming from Cotonou to Ghana attract five percent duty rate. The Ghana government reduce the duty rate and make the duty on old vehicles higher in order to discourage importation of old vehicles.

“But here, the federal government is saying they want to encourage local manufacturers of vehicles but there are no manufacturers in place to meet up the number of vehicles required in Nigeria. So the call by the CG is in line, they should reduce the tariff especially for commercial vehicles. The duty rate for commercial vehicles should be reduced to 10 or five percent to encourage movement of persons.”