Spare a thought for any analyst who has to forecast the exchange rate for Nigeria’s naira.

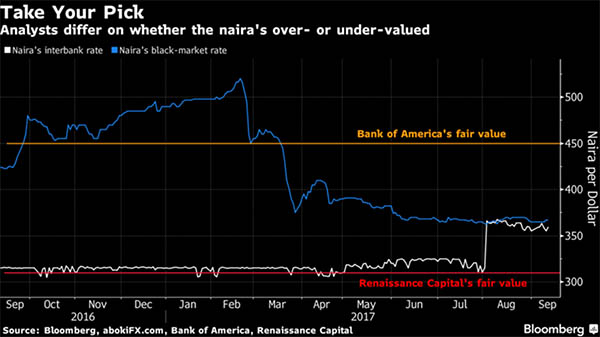

Just calculating whether it’s overvalued or undervalued, let alone by how much, is tricky. This week Renaissance Capital adjusted its year-end forecast for the currency of Africa’s biggest oil exporter to 332 per dollar, from 447. It reckons that fair value is stronger still at about 310.

That puts the Russian bank hugely of out sync with some other analysts. Bank of America Corp. said last month the naira needs to weaken 20 percent to about 450, from its current exchange rate of 360, before it reaches fair value. Goldman Sachs Group Inc. and Citigroup Inc. both say a depreciation to about 400 could be what it takes before investors buy enough naira assets to end Nigeria’s dollar shortages.

Why the difference? Nigeria tightened currency controls soon after crude prices crashed in 2014, which exacerbated an economic crisis, hammered importers and deterred investment. While the central bank has eased some trading restrictions this year — including by creating a foreign-exchange window for investors in which the naira is meant to float freely — the country is still stuck with a convoluted system of multiple exchange rates and import curbs. All that makes predicting the currency’s true worth tough, to say the least.