-

Momentum seen fading as global economy approaches capacity

- Risks include tighter credit and protectionism: World Bank

Global growth is set to slow over the next two years as central banks raise borrowing rates and U.S. fiscal stimulus starts to fade, the World Bank said.

Investors are weighing the solid performance of the global economy against a host of threats, including interest-rate hikes by the U.S. Federal Reserve, the prospect of a trade war between America and China, and the election of a euro-skeptic government in Italy.

The World Bank views an unexpected tightening of financial conditions as the top risk to emerging markets and developing economies, Kose said. Still, the development lender doesn’t see imminent signs of a financial crisis brewing in emerging markets, despite recent bouts of volatility in Argentina and Turkey, he said.

A global trade war would hit emerging markets hardest, according to the World Bank, which projected the impact if every country increased tariffs to the highest levels allowed under World Trade Organization rules.

“Global growth right now is robust. This is a good time to find ways to sustain global growth,” Kose said. “Trade has always been a major factor in supporting the global economy, especially in emerging markets and developing economies.”

Taxes, Spending

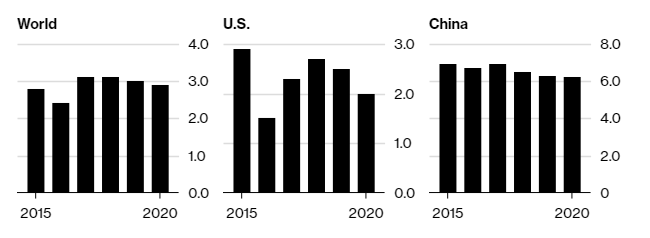

The World Bank upgraded its forecast for U.S. growth this year to 2.7 percent, up 0.2 point from January. The U.S. will grow 2.5 percent next year, up 0.3 point from six months ago. The spending increases passed by Congress in February were the main factor behind the upgrades.

The spending boost, coupled with tax cuts that took effect earlier this year, will raise the U.S. budget deficit to 5 percent of gross domestic product over the next decade, from 3.5 percent last year, according to the World Bank.

Euro-area countries are expected to grow 2.1 percent this year and 1.7 percent next, unchanged from January, the bank said.

The development lender cut its forecast for growth this year in Japan by 0.3 point to 1 percent, as higher oil prices cut into incomes and fiscal tightening drags on growth. Japan’s economy will grow 0.8 percent next year, unchanged from the forecast at the start of the year.

China will expand 6.5 percent in 2018, up 0.1 point from January, the bank said. Chinese growth will slow to 6.3 percent next year and 6.2 percent in 2020.