Customs agents in the country have called on the federal government to urgently review the valuation method on imported vehicles in line with customs law and articles VII of the World Trade Organisation (WTO) General Agreement of Tariff and Trade (GATT) domesticated under Customs and Excise Management (Amendment) Act 20 of 2003.

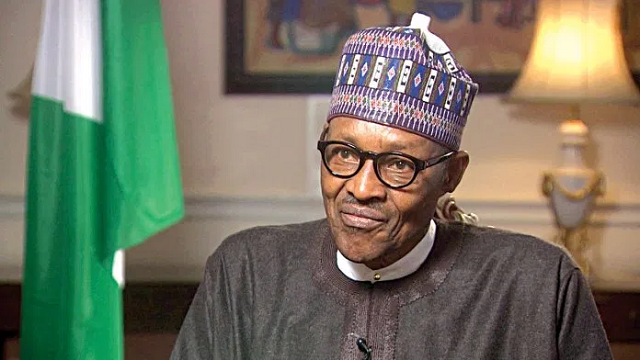

The agents stated this in a petition to President Muhammadu Buhari, signed by the President, National Council of Managing Directors of Licensed Customs Agents (NCMDLCA), Lucky Amiwero.

They stressed that the present motor vehicle data base that is in use, has not been reviewed since its inception and not been subject to adjustment in line with legal and commercial realities of international pricing on motor vehicles.

The agents in the petition stated: “The present Motor vehicle Data base that is Ex-Factory price is a component of Brussels Definition of Value (BDV) , which is not in agreement with the provision of Customs and Excise Management (Amendment ) Act, that is based on purchase price (Negotiated price with a buyer and seller) of Motor Vehicles.

“The present ex-factory price has no negotiated component as purchase price, which is the transaction value by the Importer, it lacks the legal process in the criteria as contained in the treatment of motor vehicle of paragraph 1-6 of Customs and Excise Management (Amendment) Act 20 of 2003 and cannot be used but reviewed to contain features of the element of Transaction / purchase pricing on Motor vehicles.”

In a separate petition to the Comptroller General of the Nigeria Customs Service (NCS), Col. Hameed Ali (rtd), the National Association of Government Approved Freight Forwarders (NAGAFF) said freight forwarders are confused and constrained as to what laws are subsistence and most applicable to vehicle imports valuation determination and treatment within the Customs ports.

“It is noted that vehicle importation for specific administrative practices is not meted with same treatment to general goods as obtained under the Value of Imported Goods (CEMA CAP45, Section 45 2003 No.20 of First Schedule).

“The above reference section or schedule under Cap 45 is the domesticated version of the section 20 of the Agreed Customs Valuation (ACV – 20) which is enshrined in the WTO GATT 94. The ACV clearly states the applicable methods, procedures and parameters for considerations in determining value of imported goods (which is a general application),”they said.

They added that as professional freight forwarding associations, they have grouse about the local application of this section in relation to valuation principles and treatments.

“May we posit here sir, that unfolding events within the Customs ports, especially as it relates to challenges occasioned by high-handedness and frivolousness associated with vehicles valuation and clearance have prompted us to seek your intervention by way of proffering an official clarification and applicable interplay of the extant Customs and Excise Notice No.30 of December 6, 1991, which on page 173 specifically provides guidelines on the importation of used vehicles (tokunbo).

“The notice stipulates that the basic price for all vehicles shall be the ex-factory price of the vehicle, excluding freight costs, pre-shipment, insurance charge, local duties and taxes or fees paid in the country of origin, expenses incurred for the purpose of obtaining for the local duties and levies as well as costs of registration overseas, “the agents added.

The notice, they added, also provides for age rebate on used vehicles, ranging from 10 per cent to 50 per cent of the basic price on condition that the importer can produce evidence that the imported vehicle had been licensed and had been put to use abroad.

“Contrarily, what we witness as everyday practices is contradictory to these applications as provided under the Notice. Rather vehicle imports valuation are treated with utmost secrecy by vehicle seat officers who prefer to issue unimaginable computed ex-factory price with a deliberate intent to create room for negotiations with the Customs agents. This avoidable situation thrives because the rules are not transparently defined, thereby prompting acts of arbitrariness, revenue leakages and anti-trade facilitation.”