The journey to financial success and wealth-building is not an option available to only those with a large sum of money, but rather it’s something everyone ambitious for financial success should be involved in. And when it comes to wealth building, nothing comes close to investment.

After the global recession in 2008, a lot of people began to view investment as a more righteous definition of gambling and as such were very doubtful about investing. When the topic of investment is brought up, people usually assume that the only legal forms of investment avenues are mutual funds, bonds, and the stock market.

Fortunately, financial institutions have been able to explore and make available other investing pathways that majority (especially an average Nigerian), are not familiar with.

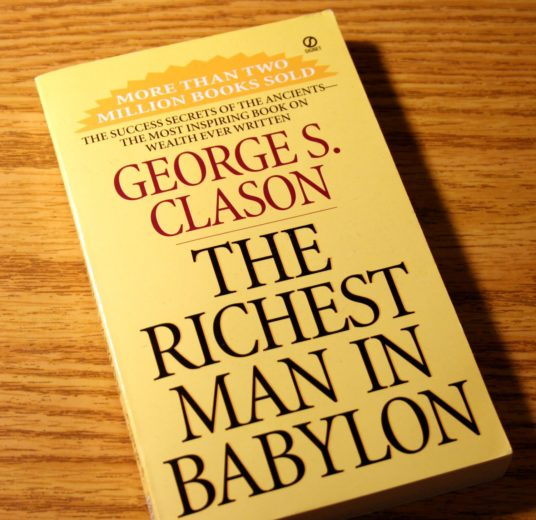

From the timeless book that goes as far back as 1926: ‘The Richest Man in Babylon’, one can extract different investment opportunities that are applicable to this recent time.

Below are some lessons in that book that have helped many people become financially stable and wealthy and I believe these lessons will help all of us build a firm financial foundation on our way to becoming the richest person we can become.

#1. Pay Yourself First (“A part of all you earn is yours to keep”)

One of the greatest lessons the book teaches is this first lesson. If you have not read this book, you might begin to assume this means keeping some money to splurge on yourself. It is, in fact, the exact opposite. Paying yourself means saving a particular percentage of your earning (salary) to be unspent for as long as it can be. This is the first and foremost way of accumulating wealth. Fortunately, some financial institutions have made it even better with target savings options that allow you earn up to 10 percent of your savings after a period of time. So rather than just leaving your money where it would not grow, you could earn more by opening a target savings account with a competent financial institution. Keeping a part of all you earn would help you greatly as it could be used as an emergency fund during the ‘rainy day’. You don’t want to imagine not having funds when you need it the most.

#2. Make your money work for you. (“Make thy gold multiply”)

This already suggests investment. While you could earn up to 10% on target saving, when you invest with qualified financial institutions, you could earn up to 20% on a fixed deposit investment. The difference here is, while you could decide to take out of your money from your target savings, you might not be able to do that with a fixed deposit investment. Fixing your money for a longer time allows it to grow more. There is nothing as good as knowing your money works harder than you do.

You might begin to wonder which one to do first, or which is more relevant, but that should not leave you confused. To make investing work better for you, you could convert your target savings funds after you have been able to accumulate it into a meaning sum and then make it work even better for you when you further invest it.

“…put each coin to work so that it may reproduce its kind even as the flocks of the field and help bring to you more income, a stream of wealth that will flow constantly into your purse.”

#3. Track Your Wealth. (Know where you are and where you are going.)

“You cannot manage what you do not measure.” – Bill Hewitt (co-founder of Hewlett Packard)

Before now, when people invest they do not take the time to properly monitor their investment. Most of the time this exercise seems tough, especially for those that do not enjoy calculating or dealing with numbers. Notwithstanding, one should, from time to time, monitor and measure their financial growth to know where they stand financially.

This is another benefit Page offers to their various clientele. As an investor with Page, you would have access to view your investment plans whenever you like. You also get to enjoy adequate expertise on how to make your money work even more for you.

Remember, “Gold clings to the protection of the cautious owner who invests it under the advice of men wise in its handling”.