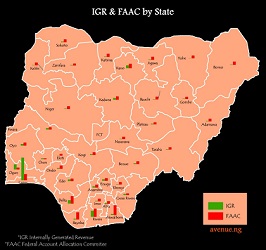

- Lagos maintains lead with over 32% share

- Rivers, Ogun, Delta, Kaduna among top five

With the exception of the Federal Capital Territory (FCT), the total internally generated revenue (IGR) by the 36 states of the federation moderately increased from N1.103 trillion in 2018 to N1.228 trillion in 2019, according to a Federation Account Allocation Committee (FAAC) report.

With the increase of N124.878 billion, as the report revealed, the total IGR of the states recorded an 11.33 percent improvement above what they raked into their treasuries in the previous financial year. However, the earnings of some states, especially in the Northeast slumped marginally and moderately within the period under review.

Compared with the composite contributions of other states nationwide to the total IGR, FAAC’s report indicated that Lagos State generated N396.128 trillion. By implication, the state’s share alone accounted for about 32.25 percent of the total IGR in 2019, a classification the country’s most populous state has been maintaining since independence.

But when analysed alongside its share of N382.181 billion in 2018, the state apparently recorded at least 3.52 percent growth in its earnings in the 2019 financial year. Despite generating N396.128 billion in 2019, the state still incurred about 48.9 percent shortfall compared with its projection to earn N775.231 billion in the same financial year.

FAAC’s report shows, the share of Lagos is over 8.22 percent more than the composite shares of 24 states in the North-central, North-east, North-west and South-east, all of which all together raked in N366.027 billion as internally generated revenue in 2019.

Coming behind Lagos State at a difference of about 64 percent, FAAC’s report revealed that Rivers, the country’s third-largest oil-producing state, generated N142.701 billion in 2019, recording revenue growth of about 20.96 percent above its N112.780 billion earnings in the 2018 financial year.

Contrasting the cases of Lagos and Rivers that respectively recorded 3.52 percent and 20.96 percent revenue growth in 2019, Ogun State reported N70.49 billion, indicating a slump of over 20.39 percent above the state’s earnings of about N88.55 billion in the 2018 financial year.

Similar to Ogun’s revenue performance, according to the report, Kano’s IGR share plummeted from N44.11 billion in 2018 to N34.02 billion, representing a 22.87 percent difference. With this significant drop in its IGR, Kano struggled to secure a place in the rank of the top ten states, reporting a very margin lead ahead of Ondo State, the fifth largest oil producing state with a daily production of about 60,000 barrels per day.

As indicated in FAAC’s report, other states that emerged in the first ten ranking respectively comprise Delta with the IGR share of about N66.01 billion; Kaduna N37.53 billion; Akwa Ibom N35.49 billion; Kano N34.02 billion; Ondo N32.72 billion; Kwara N32 billion and Edo N29.67 billion.

However, as FAAC’s report revealed, the states that ranked least among the states include Bayelsa with N11.16 billion; Ekiti N11.07 billion; Nasarawa N10.46 billion; Adamawa N9.09 billion; Katsina N8.81 billion; Borno N8.05 billion; Kebbi N7.91 billion; Ebonyi N7.52 billion; Taraba N6.3 billion, Gombe N5.65 billion and Yobe N4.46 billion.

In terms of revenue growth, as shown in the report, Adamawa remarkable recorded 46.61 percent improvement in internal revenue generation; Bauchi 37.82 percent; Borno 23.45 percent; Taraba 5.53 percent and Yobe 1.83 percent despite extremist violence or armed insurgencies by Boko Haram and its sister group, Islamic State in West Africa (ISWA) that almost put the agrarian economy of the North-east geopolitical zone to a halt.

However, Gombe, one of the Northeast states affected by the Boko Haram insurgency, reported about 23.01 percent contraction below its internal revenue performance in the 2018 fiscal year. But the Northeast, as a geo-political zone, recorded a composite revenue growth of above 16.93 percent above its 2018 share of actual IGR totalled N40114 billion.

Ekiti, a purely agrarian state, witnessed an unprecedented increase in its IGR from N6.47 billion in 2018 to N11.07 billion in 2019. The increase represented about 71.09 percent in Ekiti’s revenue growth. Likewise, Kebbi, another agrarian state in the Northwest, recorded 62.09 percent growth in its internal revenue generation from N4.88 billion in 2018 to N7.91 billion in 2019.

Among other factors, according to some analysts, Ekiti’s rice revolution and the production of LAKE Rice, a national rice project jointly spearheaded by Lagos and Kebbi States, largely contributed significant progression the two states (Ekiti and Kebbi) recorded in their revenue performance in the 2019 fiscal year.

Similar to the cases of Ekiti and Kebbi States, Benue equally recorded 77.51 percent revenue progression over its IGR share in 2018; Kogi 48.02 percent; Niger 43.99 percent; Kwara 38.85 percent; Nasarawa 38.18 percent and 33.93 percent. All together, FAAC’s report revealed, the North-central states generated N111.22 billion.

However, FCT is not included in the composite share of North-central states.

Of the six geo-political zones nationwide, Southwest ranked topmost with the IGR share of N555.961 billion, which accounted for 45.26 percent. With its share of N311.203 billion, South-south came a distance behind the Southwest, thereby contributing about 25.34 percent of the total IGR.

Also, the report indicated that the seven states that constitute the Northwest geo-political raked in N121.537 billion (9.89 percent); Northcentral N111.22 billion (9.05 percent); Southeast earned N81.463 billion (6.63 percent) and Northeast generated N46.907 billion (3.82 percent).

In terms of revenue progression in 2019, Northcentral recorded significant growth of 68.88 percent, though the IGR share of FCT was not included in the report. With the IGR share of N255.044 billion in 2018, South-south, mainly comprising oil-producing states, reported revenue growth of about 22.02 percent in 2019. While Southeast achieved 5.37 percent progression, Southwest recorded a revenue growth of about 4.3 percent.

But both Northwest and Northwest experience internal revenue regression. Perhaps, due to banditry, kidnapping and political violence, Northwest’s IGR share crashed marginally by 1.03 percent in 2019 in relation to the internal revenue of N122.798 billion it recorded in 2018. Northeast’s IGR share, similarly, slumped by 4.97 percent, which also might be as a result of armed insurgencies, extremist violence and acts of terror by Boko Haram and ISWA.