Every year, market capitalization rankings quietly tell a story most people don’t notice. It’s not just about who’s “biggest” on paper. It’s about trust, investor patience, brand gravity, and sometimes sheer stubbornness. In Nigeria’s case, 2025 was one of those years where the numbers spoke plainly—even when the economy didn’t always cooperate.

So, which companies truly dominated the Nigerian Exchange by market value in 2025? Let’s walk through them, not like a spreadsheet, but like a conversation about power, scale, and staying relevant.

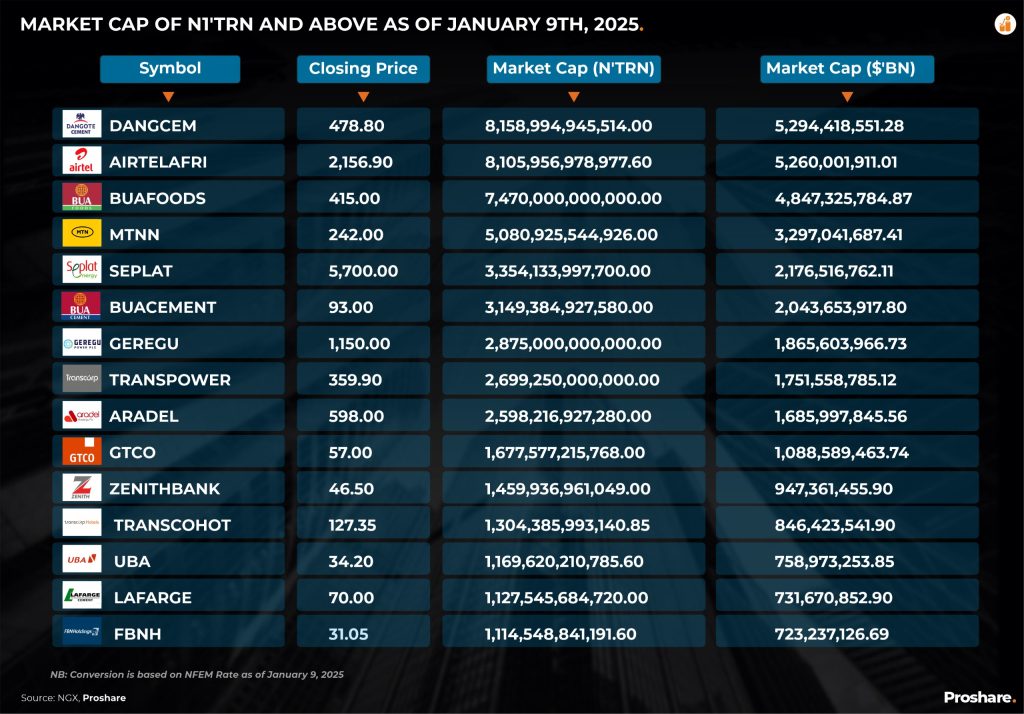

1. Dangote Cement

Let’s be honest, no one was shocked by this. Dangote Cement once again sat comfortably at the top, with a market capitalization that dwarfed most of the exchange. The company’s strength isn’t just volume; it’s reach. From Nigeria to Ethiopia to Senegal, the cement bags travel far. What helps? Infrastructure demand never fully sleeps. Roads crack, buildings rise, and governments keep announcing projects. Dangote Cement sits right in the middle of that cycle, steady, unflashy, but dependable.

2. Airtel Africa

Airtel Africa’s rise feels deliberate. Calm. Almost strategic. By 2025, the company had cemented itself as a telecom heavyweight, not just in Nigeria but across multiple African markets. Data consumption kept climbing, mobile money gained more traction, and investors liked the regional spread. Here’s the thing—telecoms now behave less like utilities and more like infrastructure backbones. Airtel understood that early.

3. MTN Nigeria

MTN Nigeria remains a fascinating case. Massive subscriber base. Strong cash flow. And yet, always one regulatory headline away from market jitters. Still, by the end of 2025, MTN Nigeria held firm as one of the most valuable companies on the NGX. Data revenue helped. Fintech ambitions helped too. The market seems to accept the risks as part of the package. You could say MTN is too big to ignore—investors certainly do.

4. BUA Cement

BUA Cement doesn’t shout. It executes. Over the years, it has built capacity aggressively, priced competitively, and expanded with minimal drama. By 2025, the market rewarded that consistency. Its valuation reflected a company that understands scale and timing. The cement space may look crowded, but BUA proved there’s room for more than one giant.

5. Nestlé Nigeria

Consumer goods companies have had a rough time lately. FX pressures, shrinking purchasing power, rising costs—you name it. Yet Nestlé Nigeria stayed in the upper ranks by market value. That’s not accidental. Brands like Maggi, Milo, and Golden Morn are deeply embedded in Nigerian households. Even when spending tightens, some products remain non-negotiable. That loyalty matters to investors.

6. Zenith Bank

Zenith Bank’s appeal is simple: discipline. Strong capital buffers, cautious lending, and an almost conservative posture have kept it attractive. In a year where banks had to manage currency shifts and policy changes, Zenith looked prepared. Its market value in 2025 reflected confidence in management more than excitement. Sometimes, that’s enough.

7. GTCO

GTCO (formerly GTBank) has something many banks struggle to maintain—brand affection. Yes, the holding company structure raised questions at first. Yes, competition is fierce. But GTCO’s digital edge and customer familiarity helped it remain one of the most valuable financial institutions on the exchange. It’s proof that perception still counts in finance.

8. Nigerian Breweries

The beer business isn’t as carefree as it looks from the outside. Rising input costs and shifting consumer habits pressured margins, yet Nigerian Breweries held its ground in 2025. The company’s distribution network, brand portfolio, and history helped cushion the blows. Investors seemed to believe the worst adjustments had already been priced in.

9. Seplat Energy

Energy companies always attract attention, especially when global oil markets wobble. Seplat Energy benefited from its dual focus on oil and gas, plus its operational footprint in Nigeria’s upstream sector. By 2025, it remained one of the most valuable energy stocks on the NGX. Gas, in particular, is becoming harder to ignore—and Seplat knows it.

10. Access Holdings

Access Holdings rounded out the top ten, powered largely by its aggressive expansion strategy. The group’s banking arm spread across Africa and beyond, absorbing risks but also opening new revenue channels. Investors seemed willing to give management time to balance growth with efficiency. Big balance sheets come with big expectations.

What This Ranking Really Says About Nigeria

If you look closely, this list isn’t random. Cement, telecoms, banking, consumer goods, and energy dominate. These are sectors tied directly to population growth, urbanization, and basic consumption. Flashy tech startups may grab headlines, but the market still values companies that sell essentials—or enable them.

And maybe that’s the quiet takeaway from 2025. In Nigeria, resilience often beats hype. Consistency beats noise. And companies that understand the terrain tend to stay standing, even when the wind changes direction.