The G20 group of finance ministers have said trade tensions could undermine the global economy.

They called for greater dialogue to reduce the risk after a tense, two-day meeting in Argentina.

The summit comes as the US ramped up trade tensions on Friday, saying it was ready to slap tariffs on all $500bn of imports from China.

France’s finance minister, meanwhile, said the EU should not negotiate trade with “a gun to its head.”

In a joint statement, the G20 ministers said risks to growth “over the short and medium term have increased. These include rising financial vulnerabilities, heightened trade and geopolitical tensions.”

“International trade and investment are important engines of growth,” they said, adding that they “recognise the need to step up dialogue and actions to mitigate risks and enhance confidence.”

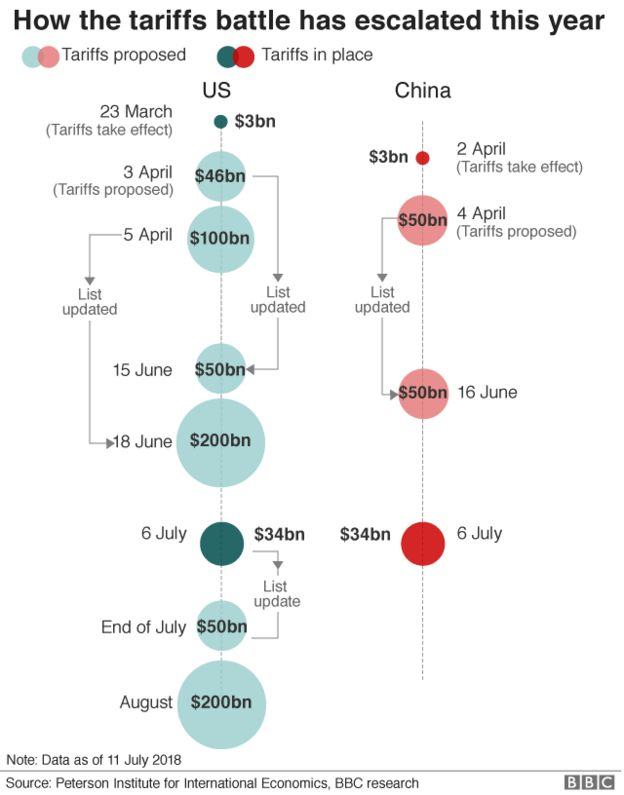

The G20 summit comes as a trade war has escalated in recent weeks after the US opened fire on 6 July with tariffs on $34bn of Chinese goods.

The US has since listed another $200bn worth of Chinese products to be targeted and has threatened tariffs on an even greater amount.

US President Donald Trump also described the EU as a “foe” on trade last week.

French Finance Minister Bruno Le Maire warned that a trade war was now a reality at the G20 summit. He said the current US trade policy of imposing unilateral tariffs was based on “the law of the jungle”.

But US Treasury Secretary Steven Mnuchin defended the tariffs and urged the EU and China to open their markets to allow free competition.

The US has large trade deficits with both the 28-member EU and China.

Given the US buys nearly four times as much from China as it sells to them, analysts fear it could seek alternative ways to get back at the US.

The two-day summit in Buenos Aires brought together finance ministers and central bankers of the world’s top 20 economies.

What did the French minister say?

“World trade cannot base itself on the law of the jungle and the unilateral increase of tariffs is the law of the jungle,” Mr Le Maire said on Saturday.

“The law of the fittest – this cannot be the future of global trade relations. The law of the jungle will only turn out losers, it will weaken growth, threaten the most fragile countries and have disastrous political consequences.”

He added that a trade war was now a reality, and that the EU could not consider negotiating a free trade deal with the US without America first withdrawing its tariffs on steel and aluminium.

What is the US argument?

Mr Mnuchin said it was pretty simple.

“My message is pretty clear, it’s the same message the president delivered at the G7 (last month in Canada): if Europe believes in free trade, we’re ready to sign a free trade agreement with no tariffs, no non-tariff barriers and no subsidies. It has to be all three,” he said.

Mr Mnuchin said China had to open its markets “so we can compete fairly”.

Tariff war. How did we get here?

Little has caused Donald Trump more annoyance than the trading deficits between the US and its major partners.

He believes that if you have a trade deficit – if you import more than you export – you are losing out.

Tackling what he has called “unfair trading practices” has become a key plank of his administration.

The European Union, China and the North American Free Trade Agreement (Nafta) countries, Mexico and Canada, have been his main targets.

Mr Trump has pulled out of the Trans-Pacific Partnership (TPP) trade deal and wants a renegotiated NAFTA deal.

The key actions so far

January: The US slaps tariffs on imported washing machines and solar panels

June: The Trump administration introduces tariffs of 25% on steel and 10% on aluminium imported into the US, arguing that global oversupply, driven by China, threatens American producers. The EU enacts retaliatory tariffs on a range of US goods, including bourbon whiskey, Harley Davidson motorcycles and orange juice

July: A 25% tariff affecting $34bn (£25.7bn) of Chinese goods begins. China retaliates in kind, with equivalent tariffs on the same value of US goods. Mr Trump threatens a 10% additional tariff on $200bn worth of additional Chinese products, naming more than 6,000 items.