The Federal Inland Revenue Service (FIRS) has disclosed that it recently discovered not less than 55,000 tax defaulters from the bank accounts substitution initiative that it embarked upon earlier this year.

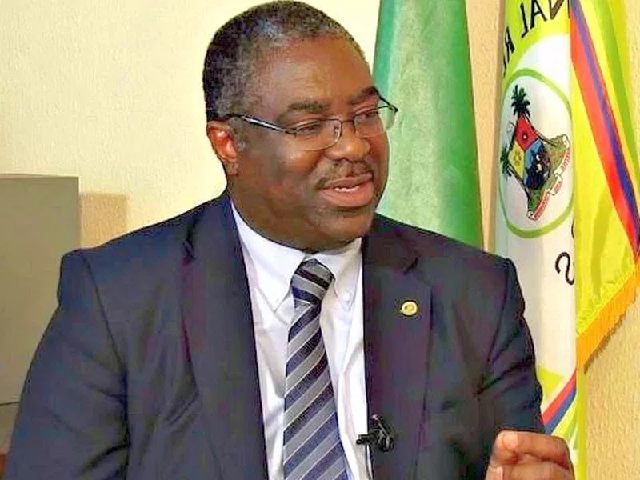

The Chairman of the Service, Babatunde Fowler, made the disclosure at a stakeholders’ forum and the official presentation of the ‘Nigerian Tax Outlook 2019,’ that took place in Lagos.

Fowler, while highlighting the achievements of the service ,especially as its recorded N5.3 trillion revenue in 2018, the highest in the history of Nigeria, he stated that the feat was made possible by the various innovations and initiatives introduced by the FIRS.

“We had the tax amnesty in 2016 and we were able to generate N96 billion from people who had not declared or paid their taxes, there is also the VAID, which equally threw up declaration of N92 billion, we also organised the stakeholders meeting requesting all to come forward, register and pay their taxes.

“At the meeting, we were able to identify over 3,700 companies that have banking turnover of one billion and above annually for three years, with no tax ID and payments.

“We went further to the banking sector earlier this year to find businesses and operators of bank accounts with a N100 million turnover, but no tax identity.

“Surprisingly, we were able to discover 55,000 non-compliance and non-tax payers among us,” he divulged.

The FIRs boss also made some clarifications on the purpose of Value Added Tax (VAT), which he said had generated controversies recently.

“VAT simply means consumption tax. A lot of people have been saying VAT is a hardship on the poor but I say that it is a support to them.

“An increase in VAT would definitely translate to a better life to the vulnerable in the society including the poor, needy and less privileged. If you don’t have money to consume, VAT is not your problem, you first of all need to have the ability and disposable income to spend, before you can be charged VAT.”

Continuing, he said: “It is a source of revenue to the state governments, 85 per cent of the revenue collected from VAT is shared among the state governments, who are supposed to directly impact my life and yours.

“It is used to assist the needy, to provide free education, free health care, social services, etc. So, when we are talking about an increase, we are talking of more support to the needy.”

He cited economies like UAE,Ghana and Saudi to have suddenly become the toast of investors because their citizens were committed to tax payment.

Founder of Tax Payers Hub, Elizabeth Aluko, explained that the publication, Nigerian Tax Outlook, 2019, was to further enlighten stakeholders on Nigerian tax environment in 2019.