In an increasingly complex global economy, access to finance remains one of the most pressing issues confronting businesses, particularly in developing markets like Nigeria.

While governments and financial institutions recognise the importance of supporting homegrown enterprises, many businesses — from small-scale start-ups to established corporations — continue to face obstacles in obtaining credit. At the core of these challenges lies the issue of credit risk assessment, a key determinant of how and to whom financial institutions extend loans.

Understanding Credit Risk and Its Broader Implications

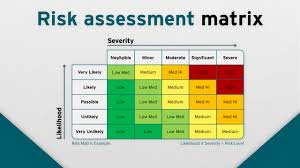

Credit risk refers to the possibility that a borrower may default on their financial obligations; a concern that banks must rigorously evaluate before approving any loan. For financial institutions, credit risk assessment goes beyond analysing figures on a balance sheet.

It involves a multidimensional process that combines advanced technology, economic modelling, and human expertise to determine a borrower’s capacity and willingness to repay.

Credit analysts are critical in ensuring that lending decisions are grounded in both data and context. They evaluate business performance, market conditions, and sectoral risks to build a full picture of each applicant’s financial health.

Such detailed assessments not only safeguard banks from losses but also strengthen confidence among borrowers. When lending processes are transparent and reliable, entrepreneurs, especially those in the SME sector, gain greater trust in the financial system, encouraging them to seek legitimate financing to grow their ventures.

Reputation and Capabilities: Key Factors for Lenders

In addition to credit risk, lenders are increasingly scrutinising borrowers’ reputations and operational capabilities in lending decisions. Banks must assess the track records of businesses applying for loans, examining factors such as financial management practices, the quality of their products or services, and their commitment to fulfilling contractual obligations. A solid history of timely repayments, robust financial controls, and a transparent operational structure can greatly enhance a company’s chances of securing funding.

Current Landscape of Non-Performing Loans in Nigeria

Recent Q3 2025 reports indicate stabilisation and improvements in non-performing loans (NPLs) across several Nigerian banks, driven by enhanced recovery initiatives, regulatory reclassifications, and proactive provisioning. While economic pressures such as inflation and FX volatility persist, these developments underscore the importance of robust credit risk management. Notable banks with updated NPL metrics include:

Access Bank: Recorded an NPL ratio of approximately 2.8% in its Q3 2025 financial report, demonstrating superior asset quality and leadership among Tier-1 peers through aggressive loan recoveries and strong coverage.

Zenith Bank: Reported NPLs of around 3.0%, marking a continued decline from prior periods via write-offs and portfolio monitoring, supporting sustained profitability with a ROAE above 25%.

First Bank of Nigeria: Saw its NPL ratio improve to approximately 8.5%, a reduction from earlier highs. However, it remains elevated and highlights the need for ongoing enhancements in risk frameworks and impairment strategies.

Guaranty Trust Bank: Noted an NPL ratio of 4.5%, reflecting positive momentum with improved coverage at 146.9%, even as the loan book expanded 20.5% to N3.36tn.

United Bank for Africa (UBA): Reported NPLs of about 5.6%, maintaining stability amid 10% loan growth and economic headwinds, with coverage at around 58% bolstering resilience.

Ecobank Nigeria: Experienced an NPL ratio of around 5.3% at the group level (proxy for Nigeria operations), benefiting from remediation programs that reduced ratios from 6.7% in December 2024.

Stanbic IBTC Bank: Recorded an NPL ratio of approximately 4.2% in its H1 2025 financial report, with a management target below 5% for the full year, supported by effective write-backs and resilient asset quality amid strong profit growth.

The stabilising NPL landscape across these institutions points to a maturing banking sector response to challenges, with the average NPL rate across Nigerian banks estimated at around 5.0% as of Q3 2025. This progress reinforces the critical role of effective credit risk assessment strategies in maintaining financial stability and fostering long-term economic growth.

While 11 banks exceeded the 5% threshold in April 2025 (pushing the industry average to 5.62%), subsequent reports show stabilisation or declines, with IMF projections at 4.5% (expected to rise modestly). High impairment charges (N1.96tn across the top 8 banks in 9M 2025) signal caution, but effective risk management has mitigated systemic risks.

Rigorous due diligence and “enhanced credit assessments” remain vital, especially for outliers like FirstBank, Access Bank, Uba, and others, but the sector’s average stability (projected ~3.8-4.5% for full-year 2025) suggests improved resilience.

Broader Impacts: Creating a Supportive Ecosystem

In light of this context, the commitment to provide financing for businesses, especially SMEs and local businesses, accelerates local production and boosts home-grown products and services; thereby contributing to the drive for ‘Made in Nigeria’ products – a crucial stimulant for the Nigerian economy. Financial institutions are increasingly aware that supporting local businesses can yield significant economic benefits while ensuring a more robust and resilient banking environment. By dedicating resources to encourage sustainable lending practices, banks can foster innovation and growth among local businesses.

Ultimately, a supportive ecosystem for local businesses, characterised by adequate financing and a commitment to community development, is essential for the overall growth of the economy. As banks navigate the challenges of credit risk assessment, their efforts not only help to sustain individual enterprises but also contribute to the long-term health and prosperity of the national economy.