Chipper Cash, a fintech platform conceived by Ham Serunjogi and Maijid Moujaled, in 2018 has raised $100 million Series C funding, making it the fifth African startup to achieve unicorn status.

The platform was created to aid payments across countries in Africa and has continued to make strides that have culminated in its unicorn status.

Leading the Series C funding round was an investment company, SVB Capital, a subsidiary of Silicon Valley Bank.

Other participants include Jeff Bezos’ fund firm, Bezos Expeditions, 500 Startups, Ribbit Capital, Deciens Capital, Brue2 Ventures, and Tribe Capital.

Prior to this funding round, Chipper Cash had, in June 2020, raised $13.8 million Series A led by Deciens Capital, and other participatory investors, and in November 2020, it raised $30 million Series B led by Ribbit Capital and Bezos Expeditions.

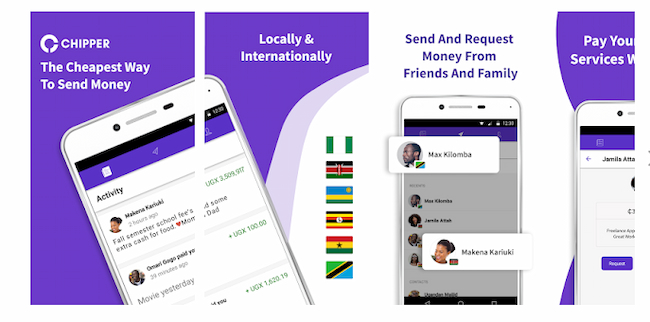

Chipper Cash has a presence in seven African countries including South Africa, Nigeria, Ghana, Uganda, Kenya, Tanzania, and Rwanda, offering free P2P payment services.

READ ALSO: Experts Laud CBN’s Proposed Digital Currency Initiative

Chipper Cash Expansion

With the infusion of cash, the company seeks to expand its workforce by 100 added to its current 200 employees, serving its 4 million current customers.

Speaking to TechCrunch, the fintech company’s Chief Executive Officer (CEO), Ham Serunjogi, disclosed that the company had taken its services outside the shores of Africa.

Serunjogi also shared the products launched by the firm including cards and a crypto product.

He said, “We’ve expanded to the U.K., it’s the first market we’ve expanded to outside Africa.

“We’ve launched cards products in Nigeria and we’ve also launched our crypto product. We’re also launching our US stocks product in Uganda, Nigeria and a few other countries soon.

“Our approach to growing products and adding products is based on what our users find valuable.

“As you can imagine, crypto is one technology that has been widely adopted in Africa and many emerging markets. So we want to give them the power to access crypto and to be able to buy, hold, and sell crypto whenever.”

Chipper Cash’s decision to provide crypto products in Nigeria might be frustrated by regulatory authorities.

The Central Bank of Nigeria (CBN), in a circular, had expressly prohibited financial institutions from process crypto transactions, as it was deemed “speculative” and an avenue through which illicit funds flow through.

On the challenges that will be faced by the fintech firm and how to deal with losing out on tapping into the crypto possibilities in Nigeria – Africa’s largest cryptocurrency market – Serunjogi said that the firm was “looking forward to any development in Nigeria that allows it to be offered freely again.”

Tech companies like Egypt’s Fawry, Nigeria’s Interswitch, Jumia, and Flutterwave have already paved the way for other startups to rise to unicorn status, with Serunjogi crediting the rise of Flutterwave to CBN policies.

He said, “Nigeria has probably the most exciting and vibrant tech ecosystem in Africa. And that’s credit directly to CBN for creating and fostering an environment that allowed multiple startups like ourselves and others like Flutterwave to blossom.

“Obviously, we’re not getting into our valuation, but we’re probably the most valuable private startup in Africa today after this round. So that’s a reflection of the environment that regulators like CBN have created to allowed innovation and growth,” he said to TechCrunch.