The Central Bank of Nigeria (CBN) on Tuesday said it will restrict banks customers whose Bank Verification Number (BVN) appears in its Watch List from accessing banking services such as ATM, PoS, USSD, Internet Banking and Mobile Banking.

However, it added that violators will not be allowed to issue third-part cheques but inflows may be allowed, provided these are from legitimate sources.

This is one of the sanctions that will be meted out to banks customers on the watch-list, according to the CBN, as part of ways to address the rise in the incidence of frauds and to enhance public confidence in the banking industry.

The apex bank described the BVN Watch-List as a database of customers identified by their BVNs, who have been involved in confirmed cases of breaches, as defined within the BVN framework.

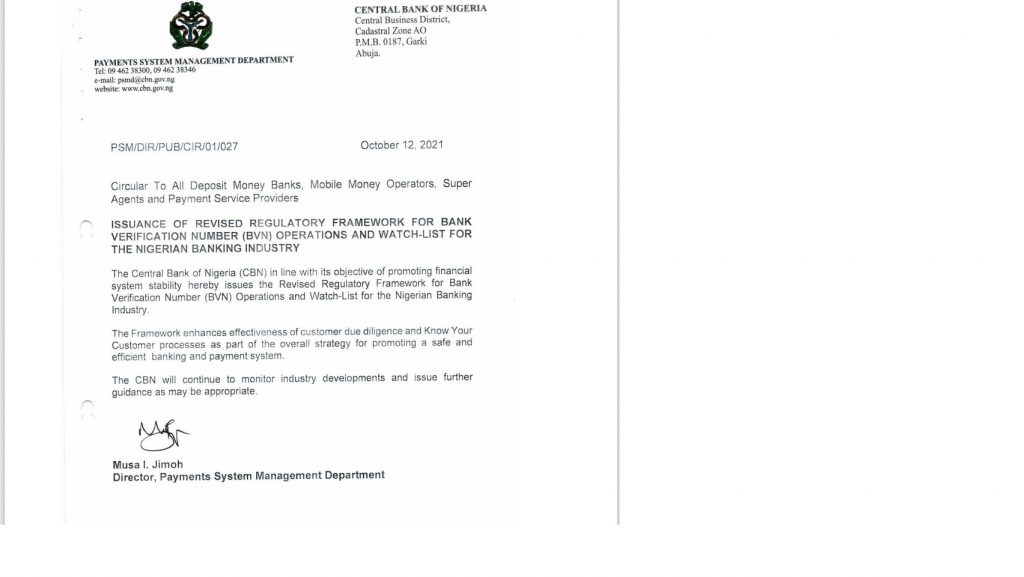

The guidelines, sanctions and punishment for breaches by customers and other stakeholders are contained in a “Revised Regulatory Framework for Bank Verification Number (BVN) Operations and Watchlist for the Nigerian Banking Industry’.

The CBN said such restriction may last for between five to 10 years.

Under the revised framework signed by CBN Director, Payment System Management Department, Mr. Musa Jimoh, the regulator said no new account/wallet (except Tier 1) shall be allowed to operate without BVN (except inflows).

It said any account/wallet (except Tier 1) without BVN shall be closed within 30 days.

The apex bank added that customers who breach the BVN regulations and are subsequently placed on the watchlist, such persons or organisations shall not be allowed to enter a new relationship with any participant, including banks and other financial services providers.

Also, a participant may choose not to continue business relationship with account/wallet (except Tier 1) holder on the watch-list.

According to the new guidelines, a customer with watch-listed BVN shall not reference accounts, access or guarantee credit facilities and shall remain on the watch-list for a specified period.

READ ALSO: Osinbajo Did Not Call For Naira Devaluation — Laolu Akande

The bank also pointed out that in the event of a recurrence of breach, the penalty period shall run consecutively.

Explaining the process of adding a customer to the BVN Watch-List, the CBN said, “Once a breach is established, in the process of investigation/fair hearing, a customer’s account shall be placed on Post-No-Debit (PND), the customer shall be notified through verifiable means within five (5) business days.

It said breaches include, but not limited to: any breach without monetary value; any Breach with monetary value; when a customer is watch-listed more than once; deceased customer; and any breach with individual at large.

The apex bank also listed sanction for banks and other financial that flouts the regualtion.

It said financial institution that activates a bank account or wallet without BVn will be liable to pay a fine of N2million.