The inability of Nigerian flour millers to access foreign exchange for the importation of wheat and other production inputs is threatening to push up the price of flour and bakery products.

Findings by BizWatch Nigeria showed that flour millers in the country have turned to unofficial forex traders and are sourcing for dollars at a price as high as N520/$ from the parallel market when forex is available at an official rate of N410.26.

This represents a difference of N109.74 in the exchange rates, indicating that flour millers are likely to pay more for importing wheat.

This dollar squeeze for the importation of wheat for the production of flour, according to analysts, will further push up the price of bread and other confectionery.

Wheat is important to the diet of many Nigerians as it is a major component of wheat flour and other staple foods such as pasta, bread, cake, noodles and spaghetti, among others.

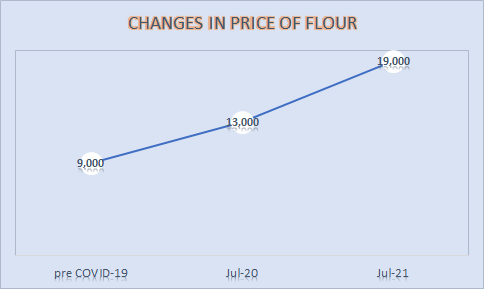

Bakers two weeks ago raised an alarm of the price of flour has increased by about 111 percent within a year.

The Association of Master Bakers and Caterers in Lagos and Abuja complained of a hike in the prices of baking materials, including flour as a result of the unavailability of forex and devaluation of the naira.

According to the group, before COVID-19, a bag of flour sold for N9,000, increased to N13,000 in July last year but now cost N19,000.

The association stated that bakers have refused to increase the prices of their various products despite the increment in order not to make things hard for the final consumers.

The National President of Bakers Association of Nigeria, Prince Jacob Adejorin, said, “Bakers are in debt and many have stopped working. Many of us are no longer in the business. Some have returned to their villages and others are riding tricycles just to survive. We are suffering in silence,” he added.

”We as an association have refused to increase the price of any of our products because we know this would have a negative impact on the economy”, a joint statement by Mr. Akintola Taiwo and Ibitoye Oladapo, of the Lagos State Association of Master Bakers and Caterers of Nigeria (LSAMBCN).

Rising Bread Prices

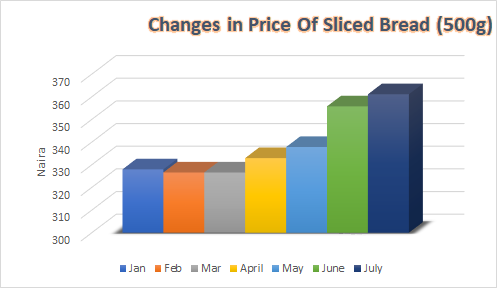

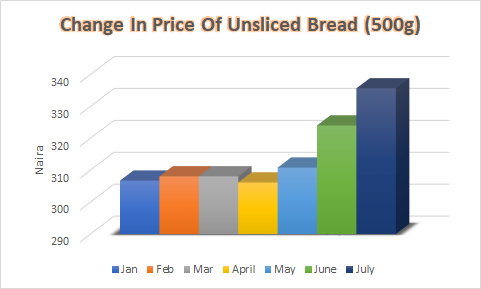

Indeed, the gradual increase in the price of wheat-based staples, bread inclusive, from January till date is one of the key contributors to the food inflation, according to the NBS inflation report.

Also, NBS data on food prices showed that the price of sliced bread has increased by 10.1 percent between January and July 2021 while unsliced bread has increased by about 9.4 percent.

The dollar crunch is happening one month after the Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, announced the suspension of forex sales to Bureaux De Change (BDC) operators and promised to channel the forex to commercial banks.

Emefiele had asked the banks to ensure forex is made available to customers for legitimate transactions and also threatened to sanction banks discovered to be involved in the hoarding of foreign currency.

In addition, the apex bank this year had introduced several initiatives to boost forex reserves, one of which is the ‘Naira 4 Dollar’ initiative.

Wheat Import Trend

Nigeria will continue to rely on grain imports for food security as the country is challenged with coronavirus (COVID-19) restrictions, currency devaluation and climate change, according to a Global Agricultural Information Network (GAIN) report from the US Department of Agriculture (USDA).

The President of Wheat Growers Association of Nigeria, Salim Muhammad, also explained that the insecurity in North-Eastern states was affecting wheat production outputs as wheat farmers in the region are unable to cultivate their farmlands but have fled to other regions for safety.

Domestic wheat production, according to Food and Agricultural Organisation (FAO) estimate will be 58,000 tonnes in the 2021 marketing year.

Despite the government’s efforts to boost domestic production and ensure self-sufficiency in wheat production, the COVID-19 containment measures, according to wheat farmers resulted in higher post-harvest losses last year.

To meet the demand for wheat-based products, millers bridge the production shortfall by importing the commodity.

FAO estimates that Nigeria millers will import 5.7 million tonnes of wheat to meet both food and non-food needs of the country as against 5.3 million tonnes of wheat that were imported in 2020.

NBS data showed that Nigeria in the first quarter of the year imported wheat worth N258.3billion on wheat importation, mainly imported from Lithuania and Latvia – countries known for producing poor-quality wheat.

Wheat, is the third most imported good, accounting for 3.77 percent of total imports in the first quarter of this year and putting a lot of pressure on forex reserves.

A year-on-year comparison showed that the import value increased by 102 percent compared with durum wheat valued at N127.85 billion imported from the United States, Latvia, Canada, Argentina, Russia and Lithuania in the same period last year.

Forex Restriction For Wheat Importation

The Central Bank of Nigeria (CBN) earlier this year announced its plans to include sugar and wheat on the list of imported items with foreign exchange access restrictions.

“We are looking at sugar and wheat. We started a programme on milk about two years ago. Eventually, these products will go into our forex restriction list,” Emefiele said.

He said CBN’s decision to place sugar and wheat on the FX restriction list is because “we spend $600 million to $1 billion importing sugar into the country annually”, and “we must all work together to produce these goods in Nigeria rather than import them”.

In 2015, the apex bank restricted 41 items from accessing foreign exchange, adding that the measure was to encourage local production of the items and conserve Nigeria’s foreign reserves.

Some of the banned items are rice, cement, margarine, palm produce, beef, vegetables, poultry and eggs, wooden doors and iron rods, including maize which was banned in 2020.

Though the plan is to conserve the country’s external reserves and 2021) and encourage local production amid forex supply dearth, analysts warn that this will push up food prices and worsen inflation.

Analysts at Financial Derivatives Company (FDC) led by Bismarck Rewane higher cost of sourcing for forex from the parallel market will be passed on to consumers by manufacturers.

They said, “The impact of higher import costs on economic agents largely depends on who absorbs the increased costs. If manufacturers decide to bear the burden, it means operating expenses will increase, weighing significantly on corporate margins.

“Manufacturers may however decide to pass on the additional cost burden to consumers in form of higher prices. This will further squeeze consumer disposable income.

“This is troubling at a time when poverty and unemployment rates are climbing. It could be a recipe for social unrest and an increased crime rate.”

According to the analysts, there has not been enough investment in the local wheat industry to meet growing demand and in some cases, and that the varieties of wheat produced in the country do not meet manufacturers’ requirements.

When contacted, the Public Relations Officer of Abuja Master Bakers , Nura Musa, said bakers, farmers, millers and the government are in talks to find a lasting solution to the forex restriction for wheat.

According to him, bakers have suspended the planned strike action to allow for a decision to be reached.