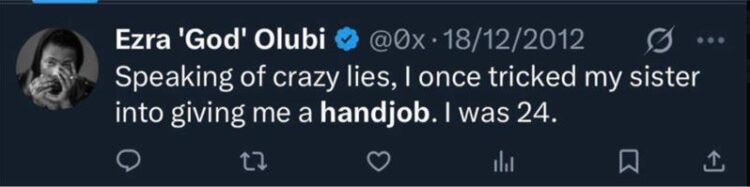

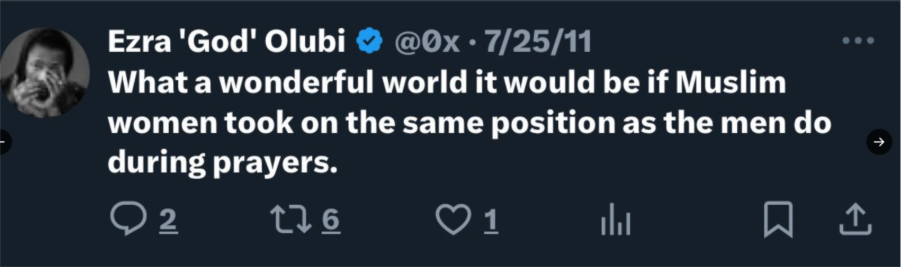

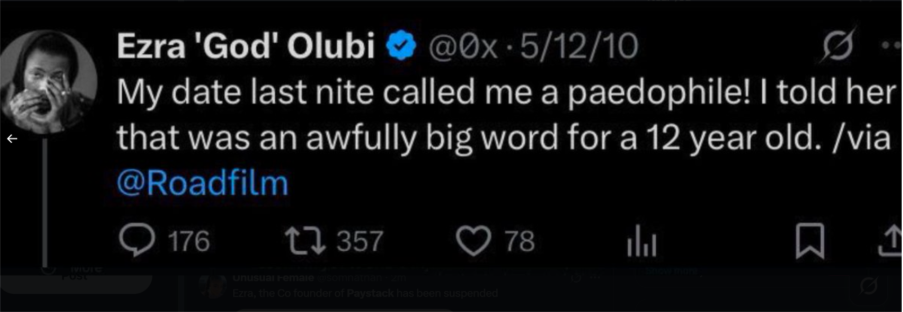

Nigerian fintech giant, Paystack, has suspended its Co-founder and Chief Technology Officer, Ezra Olubi, following the resurfacing of sexually explicit tweets he allegedly posted more than a decade ago. The posts, which circulated widely on X on Thursday, contained graphic remarks involving minors and references to sexualised anime characters.

In a statement on Friday, the company confirmed it had initiated a formal probe into the allegations.

“Paystack is aware of the allegations involving our Co-founder, Ezra Olubi. We take matters of this nature extremely seriously. Effective immediately, Ezra has been suspended from all duties and responsibilities pending the outcome of a formal investigation,” the statement read. The company added that it would not comment further until the process is concluded.

Olubi, known for a public persona that often sparks social-media debate, has not issued any response. He deactivated his X account on 13 November amid growing public backlash. In 2022, he received a national honour — the Order of the Niger (OON) — from former President Muhammadu Buhari.

A Spotlight on Conduct in Africa’s Tech Ecosystem

Olubi’s suspension comes at a time when concerns around child sexual abuse are prompting stronger institutional and legal responses across Nigeria. The Senate recently passed amendments to the Criminal Code Act that prescribe life imprisonment for anyone convicted of defiling a minor. The reforms, adopted in October, eliminate fines, remove gender bias in the definition of rape, and abolish statutes of limitation for offences involving minors.

The heightened scrutiny underscores an evolving expectation of accountability in Nigeria’s tech sector, which has grown rapidly and now attracts intense global attention.

Paystack’s Influence and Global Standing

Established in 2015 by Shola Akinlade and Ezra Olubi, Paystack has evolved from a Lagos startup into one of Africa’s most influential payment infrastructure companies. The firm enables businesses to receive payments through cards, bank transfers, USSD, QR codes, and mobile money.

Paystack gained early global visibility after entering the Y Combinator accelerator in 2016 and raising $1.3 million in seed funding. Momentum continued with an $8 million Series A round in 2018 led by Stripe, Visa, and Tencent. In 2020, Stripe acquired Paystack in a landmark $200 million deal — one of the largest fintech exits in Africa.

More recently, Paystack led a consortium to acquire Brass, expanding its footprint into SME-focused financial tools. Because of its scale, global partnerships, and integration into Stripe’s payments ecosystem, the company’s handling of the allegations against Olubi is being closely monitored within and beyond Africa’s technology community.