The Securities and Exchange Commission (SEC) has called on stockbrokers to strengthen their commitment to professionalism, ethics, and transparency to build investor trust and enhance Nigeria’s capital market integrity.

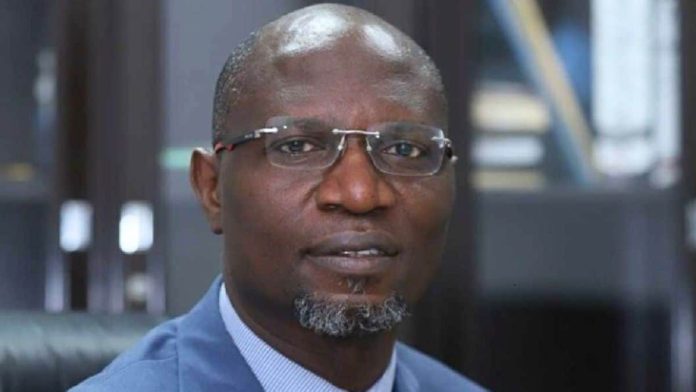

The SEC’s Director-General, Dr. Emomotimi Agama, made this appeal in a statement issued in Abuja on Sunday, stressing that market intermediaries must maintain the highest standards of honesty and competence.

Agama emphasized that ethical conduct is fundamental to a trustworthy investment environment, noting that investors must have confidence that their portfolios are being managed with transparency and accountability.

He further highlighted that digitisation, ethics, and sustainability form the foundation of modern capital markets globally, as technological innovation continues to reshape investment practices.

“Across the world, capital markets are being transformed by technology—from online trading and digital assets to data analytics, blockchain, and artificial intelligence,” he said.

“These innovations are redefining how we raise capital, invest, and regulate markets.”

Agama added that the SEC is leveraging digital tools to enhance efficiency, improve transparency, and strengthen investor protection. He also noted that the Commission is collaborating with the Chartered Institute of Stockbrokers (CIS) to deepen digital literacy and professional capacity in the market.

“As technology evolves, so must our ethics and professionalism,” he stated. “No innovation can replace the foundational importance of integrity.”

He reiterated that a sustainable and inclusive capital market must be anchored on transparency, accountability, and ethical discipline, which remain essential to attracting both local and foreign investments.