As inflation continues to bite and the battle for top-tier talent intensifies, Nigerian banks are being forced to make bold decisions in how they reward their workforce. The competition is not just for market share anymore—it’s also about attracting and retaining the best minds.

While some financial institutions have responded by significantly boosting employee compensation, others still operate on leaner pay models, relying more heavily on junior staff and branch-driven operations.

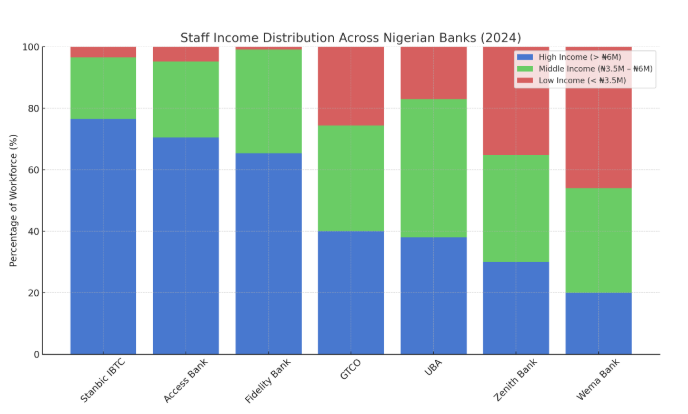

Nairametrics recently analyzed the 2024 financial statements of nine publicly listed Nigerian banks. Their findings shed light on sharp differences in compensation structures across the industry. From executive-heavy institutions focused on high-end services to mass-market banks with a lower pay threshold, the data paints a vivid picture of how each bank values its workforce.

How Pay Was Assessed

To make sense of the pay structures, employees were categorized into three income brackets:

- High income: Above ₦6 million annually

- Middle income: ₦3.5 million – ₦6 million annually

- Low income: Below ₦3.5 million annually

The analysis compared the percentage of each bank’s workforce that fell into these brackets and examined how many executive and management staff they employed. These factors provide insight into the operational models and staff hierarchies within each institution.

Banks That Pay the Most: Stanbic IBTC Leads the Pack

Topping the list of best-paying banks is Stanbic IBTC, where a whopping 76.5% of employees earn over ₦6 million annually. This suggests a workforce skewed toward professionals and executives, possibly due to the bank’s focus on wealth management, investment banking, and corporate services.

Close behind is Access Bank, with 70.5% of its staff in the high-income category. The bank’s extensive restructuring and focus on digital transformation seem to have led to an investment in highly skilled professionals.

Fidelity Bank follows at 65.3%, showcasing a deliberate pivot toward a well-compensated professional workforce, perhaps to boost competitiveness and operational efficiency.

These banks appear to have largely exited the junior staff bracket, embracing digital and centralized models over manual and branch-based operations.

Banks With the Largest Share of Low-Income Staff

Not all banks are prioritizing high-end compensation. Some continue to rely on a junior-heavy staffing model.

Wema Bank stands out in this regard, with 46% of its workforce earning below ₦3.5 million annually—the highest percentage among all banks analyzed. This reflects its retail-heavy model and likely a large number of tellers, customer service agents, and other support staff.

Zenith Bank, despite its large size and profit record, has 35.2% of staff in the low-income bracket, while GTCO (Guaranty Trust Holding Company) has 25.6% in the same category. Both banks may be relying on a mixed operational model with sizable junior-level staff bases.

In contrast, Stanbic IBTC (3.5%), Fidelity Bank (0.9%), and Access Bank (4.8%) have almost completely phased out this pay category. This shift indicates a move toward leaner but more specialized teams supported by automation and advanced tech infrastructure.

Middle-Income Balance: GTCO and UBA Shine

While some banks have gone top-heavy and others remain bottom-loaded, a few institutions have achieved a more balanced compensation structure.

GTCO leads the way here, with a strong presence of staff in the middle-income category. This suggests a well-developed layer of experienced professionals, team leaders, and mid-tier managers who serve as the backbone of daily banking operations.

UBA (United Bank for Africa) follows a similar path, investing in its middle layer to ensure stability and continuity in service delivery. For job seekers looking for growth, development, and long-term prospects, such a structure could offer a more supportive and sustainable environment.

Leadership Structures: Who Has the Most Executives?

Beyond pay, the number of executive and management staff reveals how banks are structured internally.

- Access Bank has the most expansive leadership tier, with 1,013 management staff and 15 executive directors overseeing a workforce of 8,939. This suggests a complex, perhaps global-facing strategy that demands layered leadership and specialized roles.

- In contrast, Zenith Bank manages over 9,300 employees with just 196 managers—a sign of a more streamlined, top-down model with operational efficiency at its core.

- Wema Bank maintains the leanest structure, with just 32 management staff for over 2,300 employees. This minimal leadership layer reinforces its retail and transactional banking focus, where operations are mostly handled at the grassroots level.

What the Data Tells Us

The varied compensation structures and staff models across Nigerian banks reflect deeper strategic differences:

- Stanbic IBTC, Access Bank, and Fidelity Bank: These banks clearly prioritize a top-heavy model. With the majority of their workforce earning above ₦6 million, they are positioning themselves as elite, digitally forward, and highly professional institutions. This is attractive to skilled workers but may come at the cost of operational diversity.

- GTCO and UBA: Their balance between middle and high-income staff suggests they value operational consistency and team development. These banks appear to reward experience and encourage a growth pipeline for staff.

- Wema Bank: The high percentage of low-income staff and small leadership pool point to a mass-market, branch-reliant strategy. It’s effective for retail banking but may not appeal to professionals seeking upward mobility.

- Zenith Bank: A hybrid player with a significant junior workforce but a lean management core, Zenith appears to prioritize operational control and scalability over layered leadership or heavy investment in mid-tier talent.

Why This Matters

In a time of high inflation, job scarcity, and fierce competition for talent, how banks pay their staff is not just a matter of budgeting—it is a reflection of their long-term strategy, customer base, and growth direction.

- For job seekers, understanding which banks invest in staff development and offer competitive pay can inform career decisions.

- For investors, a bank’s compensation model may signal its level of innovation, operational efficiency, and market focus.

- For policymakers, it provides insight into how the financial sector is adapting to labor market pressures and digital transformation.

In the long run, banks that fail to offer competitive compensation risk losing skilled talent to fintechs, global banks, or even entirely different industries. Meanwhile, institutions that over-invest in executive-heavy models may struggle with inefficiency if not balanced with strong operational teams.

Conclusion

The Nigerian banking sector is in a state of evolution. With technology reshaping services, customer expectations changing, and inflation eroding purchasing power, banks must make hard choices about how they structure and reward their teams.

Whether you’re a young graduate looking for your first job, an experienced banker evaluating new offers, or an investor trying to read between the lines of financial statements, understanding which banks pay the most—and why—could offer crucial insights into where the industry is headed.

As the war for talent heats up, one thing is clear: in Nigeria’s banking sector, compensation is more than a paycheck—it’s a statement of strategy.