The Federation Account Allocation Committee (FAAC) disbursed N1.72 trillion to the federal, state, and local governments in November 2024, reflecting a modest increase from the N1.4 trillion shared in October.

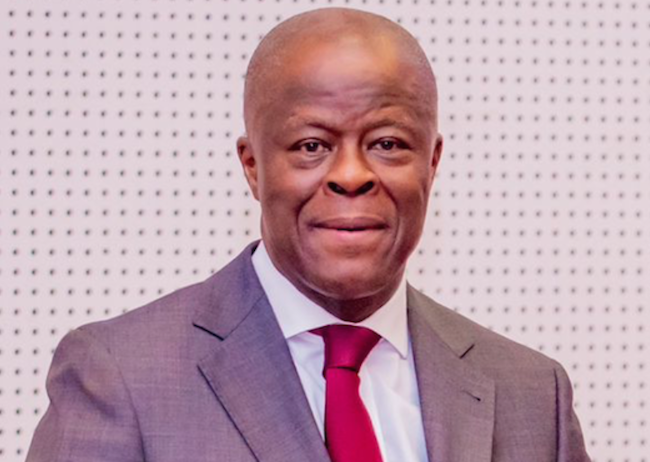

This allocation was drawn from the gross revenue of N3.143 trillion recorded in November, a notable rise from the N2.668 trillion generated in October, according to a communiqué released after FAAC’s December 2024 meeting chaired by Wale Edun, the Minister of Finance and Coordinating Minister of the Economy.

Breakdown of Revenue Sources and Allocations

The total disbursed amount comprised income from Gross Statutory Revenue, Value Added Tax (VAT), Electronic Money Transfer Levy (EMTL), and Exchange Difference (ED).

Federal Government: N581.856 billion

State Governments: N549.792 billion

Local Government Councils: N402.553 billion

Oil-Producing States (13% Derivation): N193.291 billion

Additionally, N103.307 billion was allocated for the cost of collection, while N1.312 trillion covered transfers, interventions, and refunds.

Performance of Key Revenue Streams

Value Added Tax (VAT):

The gross VAT revenue for November stood at N628.972 billion, a decrease of N39.318 billion compared to October’s N668.291 billion.

Cost of Collection: N25.159 billion

Transfers, Interventions, and Refunds: N18.114 billion

Distributable Amount: N585.700 billion

Federal Government: N87.855 billion

States: N292.850 billion

Local Governments: N204.995 billion

Statutory Revenue:

Gross statutory revenue increased significantly to N1.827 trillion in November, up by N490.339 billion from October’s N1.336 trillion.

Cost of Collection: N77.521 billion

Transfers, Interventions, and Refunds: N1.294 trillion

Distributable Balance: N455.354 billion

Federal Government: N175.690 billion

States: N89.113 billion

Local Governments: N68.702 billion

Oil-Producing States: N121.849 billion

Electronic Money Transfer Levy (EMTL):

A total of N15.046 billion was shared among the three tiers of government:

Federal Government: N2.257 billion

States: N7.523 billion

Local Governments: N5.266 billion

Cost of Collection: N0.0627 billion

Exchange Difference:

Revenue from exchange rate differentials amounted to N671.392 billion.

Federal Government: N316.054 billion

States: N160.306 billion

Local Governments: N123.590 billion

Oil-Producing States (13% Derivation): N71.442 billion

Total Distributable Revenue

The total distributable revenue for November, combining statutory allocations, VAT, EMTL, and exchange differences, amounted to N1.727 trillion.

This significant disbursement highlights an upward trend in government revenue generation and underscores efforts to ensure timely allocation to all tiers of government.