The Securities and Exchange Commission (SEC) has urged banks to prioritise robust corporate governance principles and strengthen risk management frameworks as part of efforts to boost investor confidence during the ongoing recapitalisation exercise.

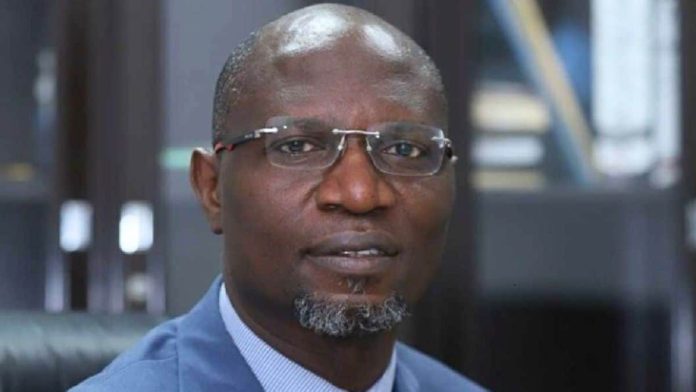

Dr Emomotimi Agama, Director-General of SEC, made the call during the annual workshop of the Capital Market Correspondents Association of Nigeria (CAMCAN), held in Lagos. Themed “Recapitalisation: Bridging the Gap between Investors and Issuers in the Nigerian Capital Market,” the workshop highlighted the critical role of corporate governance in sustaining market integrity.

Represented by the SEC’s Divisional Head of Legal and Enforcement, Mr John Achile, Agama noted that the 2024–2026 banking sector recapitalisation framework offers clear guidelines for issuers while safeguarding investors’ interests. He emphasised SEC’s commitment to ensuring transparency and efficiency throughout the recapitalisation process.

Dr Agama highlighted the importance of innovation in bridging the gap between issuers and investors, revealing that SEC is exploring blockchain technology integration to enhance transaction security and redefine market trust.

“The oversubscription of recapitalisation offers in 2024 reflects strong investor confidence,” Agama said, adding that SEC is intensifying efforts to improve disclosure standards and corporate governance practices to sustain this momentum.

To democratise market access, SEC plans to expand financial literacy campaigns and collaborate with fintech companies to provide low-entry investment options, he added.

Agama identified market volatility, systemic risks, limited retail participation, and investor scepticism as key challenges to the recapitalisation exercise. However, he pointed out opportunities to leverage technology for deepening financial inclusion, enhancing market liquidity, and developing innovative financial products like green bonds and sukuk to attract diverse investor segments.

“The success of recapitalisation efforts depends on collaboration among regulators, issuers, and investors,” he remarked, stressing the need for collective efforts to strengthen the market.

During a panel session on market infrastructure, Mr Achile reinforced SEC’s dedication to transparency, noting that the commission conducts due diligence on all market innovations to ensure compliance with regulatory requirements.

On the issue of rising unclaimed dividends, Achile attributed the challenge to investor non-compliance with regulatory requirements and information gaps. He assured stakeholders of SEC’s ongoing efforts to streamline the process and protect investors.

“We are committed to strengthening our dual role of market regulation and investor protection to boost confidence,” he said.

In her welcome address, CAMCAN Chairperson, Mrs Chinyere Joel-Nwokeoma, described banks’ recapitalisation as a critical opportunity to rebuild trust, enhance the capital market, and drive sustainable growth.

“The recent recapitalisation underscores the need for a more robust and inclusive capital market,” Joel-Nwokeoma stated. She called for stronger corporate governance, enhanced transparency, and closer collaboration between investors and issuers to foster a vibrant financial ecosystem.