…Aims for Turnaround with Rights Issue

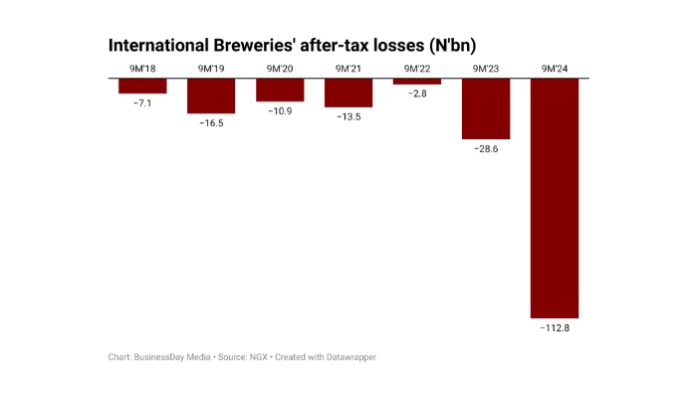

International Breweries Plc has reported a sharp increase in its after-tax losses for the first nine months of 2024, with figures surging to N112.8 billion, up from N28.56 billion in the same period last year. The significant rise in losses is attributed to higher costs across various areas, notably a jump in other expenses to N147.6 billion from N36.2 billion and an increase in cost of sales to N248.6 billion from N126.4 billion.

The company’s net finance costs also spiked to N29.2 billion, compared to N11.1 billion in 2023, even as revenue climbed to N343.4 billion, up from N183.8 billion over the same period.

Obi Achebe, Chairman of the Board of Directors at International Breweries, expressed confidence in the company’s strategic direction, citing the recent repayment of foreign currency-denominated loans as a pivotal move. He noted that eliminating exposure to foreign exchange risks was critical to enhancing cash flow and achieving long-term profitability.

“This recapitalisation, enabled by our parent company, Anheuser-Busch InBev (AB InBev), bolsters our financial position. It not only strengthens our balance sheet but also sets the stage for innovation, operational efficiency, and new opportunities,” Achebe said.

International Breweries initiated a N588 billion rights issue in May 2024, offering 161 billion new ordinary shares at N3.65 each, with the terms entitling existing shareholders to six new shares for each share held. Scheduled to close on June 10, 2024, the rights issue aims to enhance liquidity and operational resilience. AB InBev, the majority shareholder, fully subscribed to its share of the rights issue, signalling strong support for International Breweries’ growth ambitions in Nigeria.

David Tomlinson, Finance Director at International Breweries, highlighted the significance of the rights offer, particularly the tradability of rights on the Nigerian Exchange, which enhances liquidity for shareholders.

“We are committed to creating sustainable value for our shareholders and fortifying our position in the Nigerian beverage industry,” he remarked.

The rights issue follows the Nigerian Exchange Limited’s approval of a two-year extension for International Breweries’ free float compliance, now valid until July 30, 2024. This compliance allows the company more flexibility to strengthen its financial framework while engaging stakeholders and leveraging growth opportunities.

The expansion of International Breweries under AB InBev has been transformative but challenging. Since merging its Nigerian subsidiaries in 2017. Intafact Beverages, Pabod Breweries, and the original International Breweries entity, the combined operation has faced rising liabilities and increased operational costs. The newly implemented capital infusion, however, is expected to offset some of these pressures, propelling International Breweries toward a more sustainable growth trajectory as it adapts to Nigeria’s dynamic economic landscape.