In October 2020, BTC price soared by almost 30% month-over-month. Overall, it has had a strong 2020 following the mid-March slump.

Bitcoin network fees reached $42.9 million in October 2020. That was 12% of the miners’ total revenue in that month, the highest percentage since January 2018. Total revenue reached $353 million, up 8% from September.

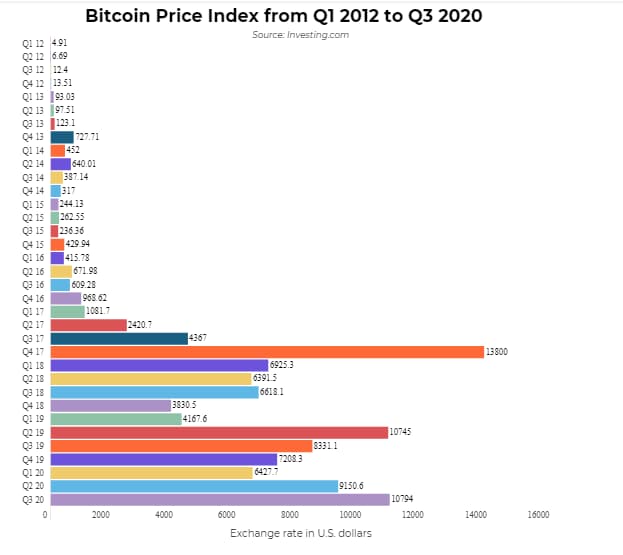

On March 12, 2020, it shed nearly 50% in tandem with the rest of the market. However, it recovered soon thereafter, going from $6,427 in Q1 to $9150 in Q2 and $10,794 in Q3 according to Statista.

According to the research data analyzed and gathered by Comprar Acciones, the increase in miners’ fees and revenue coincided with an upsurge in BTC price. Based on Coinmarketcap data, Bitcoin’s price went from $10,800 to over $13,800 in October 2020 alone. As of November 25, the top crypto is trading at around $19,300.

In the first month of Q4, it shot up by 42%, compared to 1.44% for gold, 0.00% for the dollar and 5.31% for the SPX. On November 5, 2020, it grew by 108.4% Year-To-Date (YTD). Comparatively, gold had gained 25.15%, the US dollar got 1.58% and the SPX was up by 6.58% in the same duration.

READ ALSO: Chisom Chukwuneke Who Bagged 7 A1s Dies of Cancer

Moreover, according to a study by Grayscale, 55% of US investors said they were interested in Bitcoin investments in 2020, up from 36% in 2019.

The October Bitcoin miners’ fees also had to do with mempool congestion resulting from a drop in network hash rate (BNHR). According to YCharts, BNHR went from 141.83 million on October 1 to an ATH of 147.01 million on October 18. From there, it took a nosedive to 107.64 million on October 31. Glassnode reported that Bitcoin mining revenue rose to a new yearly high of $21 million per day as of November 19, 2020.