The Nigerian Senate has guaranteed Nigerians that the implementation of the 7.5% increase in Value Added Tax (VAT) would not affect their purchasing power.

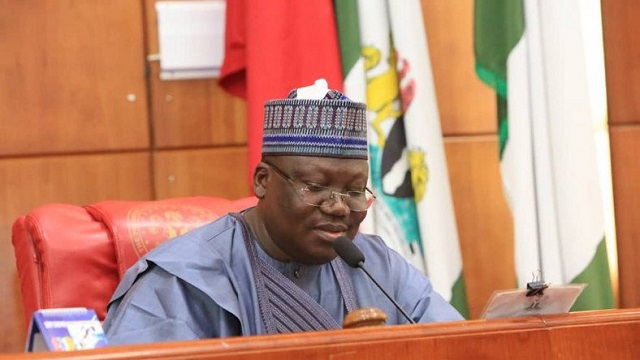

Ahmad Lawan, President of the Nigerian Senate, disclosed this yesterday while speaking on the measures being taken by the Federal Government to reduce the pressure of recent government policies on the purchasing power of Nigerians.

The Senate stated that the purchasing powers of an average Nigerian would not be affected as the increment in VAT was targeted at luxury items.

“The 2. 5% increment in VAT does not include items that ordinary Nigerians normally use. Many of the items that would now have an additional 2.5% increment are luxury items that ordinary Nigerians don’t use,” Lawan said.

Meanwhile, Lawan explained that the country was in need of additional resources to provide basic social amenities that average Nigerians require. He said this brought about the various policies changes, some of which are already in full effect and others set to take effect on February 1.

In a bid to keep the cost of living from rising for Nigerians due to the changes in VAT, the presidency through its spokesperson Garba Shehu disclosed that government of exempting 20 basic food items and some other transactions/items from the new 7.5% (VAT).

The list of exempted items includes additives (honey), bread, cereals, cooking oils, culinary herbs, fish, flour and starch, fruits (fresh or dried), live or raw meat and poultry, milk, nuts, pulses, and roots. Others are salt, vegetables, water (natural water and table water), locally manufactured sanitary towels, pads or tampons services rendered by microfinance banks, and tuition fees relating to nursery-university

In Nigeria, 85% of the collected VAT would go to states and local governments meaning that increased VAT revenues would mean that states and local governments would have more money to be able to meet their obligations.

Source: Nairametrics