- FG Targets 7% Economic Growth in 2-3 years – Adeosun

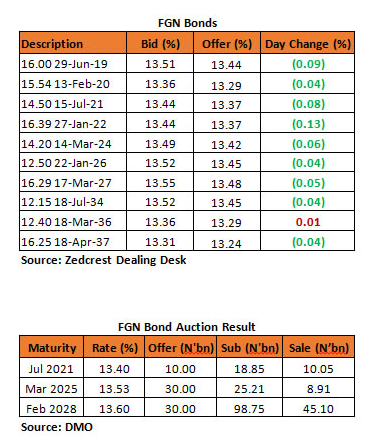

Bonds

The bond market traded on a slightly bullish note with some lifts especially on the short end of the curve, as market players cautiously tracked proceedings at the bond auction which witnessed slightly favorable demand especially on the 2028 bond, with a 2.23X total bid to cover and a significant decline in auction stop rates by c.35bps from their previous levels due to the relatively smaller volumes of bonds on offer and steady decline in secondary market yields since the last auction. We expect the market to be relatively calm tomorrow, with trickles of demand expected from some lost auction bids.

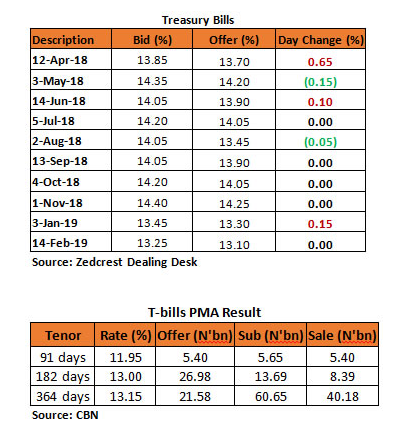

Treasury Bills

The T-bills market was slightly bearish due to the relatively tight system liquidity, forcing traders to sell down on some of their holdings. The 20-Sep and 12-Apr were the most hit, as traders took profits on them. Yields however closed on a relatively flat note, largely moderated by expectations for OMO and PMA maturities tomorrow. The CBN sold the exact amount of N53.96bn T-bills on offer at its PMA today, we however witnessed shift in volumes (N13.29bn) from the 182-day to the 364-day bill which recorded a relatively higher subscription from market players. The Auction stop rates were however not much changed from their previous levels except for the 91-day bill which rose by 20bps to 11.95%.

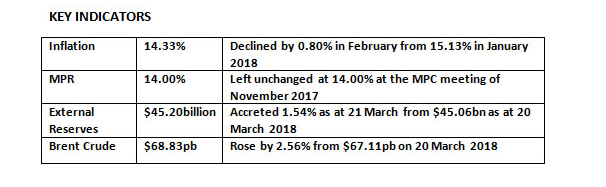

Money Market

The OBB and OVN rates moderated by c.10 percent points to 20.00% and 22.08% respectively as market players anticipated inflows from OMO and PMA maturities (c.N253bn) tomorrow. System liquidity is however currently estimated at c.N27bn, its lowest level since the 9th of February. This is however expected to improve tomorrow, even as we expect funding rates to moderate further downwards. We however expect the CBN to resume it OMO auction tomorrow, to moderate the level of Liquidity inflows into the system.

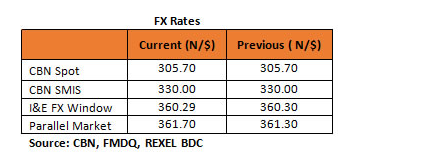

FX Market

The Interbank rate remained stable at its previous rate of N305.70/$, with the CBN’s external reserves recorded to have improved by 1.54% to $45.21n as of 20 March. The NAFEX rate closed relatively flat at N360.29/$, with total volume traded rising significantly by 110% to $384m due to some offshore interests at the NTB and FGN bond auctions. Rates in theUnofficial market however depreciated by 0.11% to N361.70/$.

Eurobonds

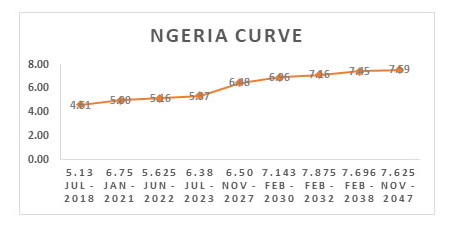

The NGERIA Sovereigns traded on a relatively flat note as yields were reckoned to have reached key resistance points following significant selloffs in the previous two sessions leading up to the FOMC’s interest rate decision. The Yield curve however remained slightly weak, with continued selloff on the 30s and 38s, while the 2047s recovered slightly with renewed demand from market players as the bond approached par.

Trading in the Nigerian banks were relatively mixed, as investors remained slightly bearish on most tickers, whilst we witnessed renewed demand for the ECOTRA 21s, DIAMBK 19s and Access 21s sub.

The FOMC hiked rates by 0.25points as was widely anticipated. We however expect yields to remain relatively stable or even moderate slightly as the FOMC maintained a relatively moderate tone on its monetary policy and inflation rate expectations.

Source: Proshare