Shares of Snap Inc dipped by 4.9 percent to their initial public offering price, highlighting investors’ loss of confidence in the social media company that faces fierce competition from Facebook.

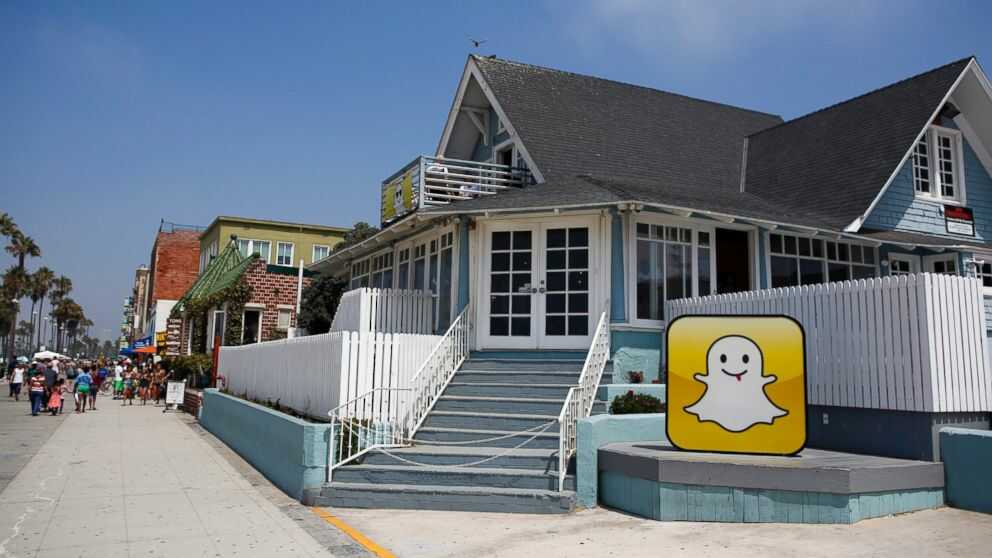

The owner of Snapchat – a mobile app that lets users capture video and pictures that self-destruct after a few seconds – ended at $17.00, the price set in its March initial public offering that was the hottest U.S. technology listing in years.

Snap climbed to $29.44 in the days immediately after its market debut but has since declined. Thursday’s price was the lowest since the IPO and it did not sink below $17.00.

Snapchat is popular among people under 30 who enjoy applying bunny faces and vomiting rainbows onto their pictures. But many on Wall Street are critical of its high valuation and slowing user growth. Snap has warned it may never become profitable.

Dipping below an IPO price is seen on Wall Street as a setback to be avoided by chief executives and their underwriters, but it is not uncommon for Silicon Valley companies whose market listings have been hyped to investors.

Snap’s IPO was popular among twenty-something investors, according to Robinhood, a mobile trading app.

It recently traded at nearly 21 times expected revenue, according to Thomson Reuters data. By comparison, Facebook has a revenue multiple of 11.6.

Snap sinks to IPO price for first time since market debut Shares of Snap Inc dropped 4.9 percent on Thursday to their initial public offering price, highlighting investors’ loss of confidence in the social media company that faces fierce competition from Facebook.

The owner of Snapchat – a mobile app that lets users capture video and pictures that self-destruct after a few seconds – ended at $17.00, the price set in its March initial public offering that was the hottest U.S. technology listing in years.

Snap climbed to $29.44 in the days immediately after its market debut but has since declined. Thursday’s price was the lowest since the IPO and it did not sink below $17.00.

Snap’s IPO was popular among twenty-something investors, according to Robinhood, a mobile trading app.

It recently traded at nearly 21 times expected revenue, according to Thomson Reuters data. By comparison, Facebook has a revenue multiple of 11.6.