Theresa May was sworn in as Prime Minister of the UK and her opening speech resounded around the world, and the British Pound recovered against the SA Rand and most currencies. But was this just a blip?

So, what does this mean to us in South Africa and what impact will this have on our struggling economy or Africa as a whole. Well, Boris Johnson was appointed UK foreign Minister.

If you recall, The Africans For Britain Group, who supported the Brexit because the group had argued that Britain leaving the EU would encourage trade with African and Caribbean nations and make it easier for people from those countries to travel to the UK. So where are they now? And what is their response? Silence is deafening.

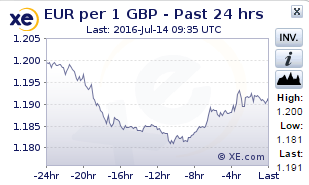

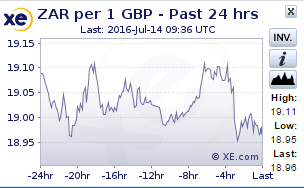

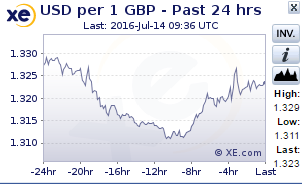

This is the view as seen in currency markets on the 14 July 2016 provided by http://www.xe.com/XE :

So can we expect the same see-saw or will the pound make a brief comeback as decisions get made and more UK announcements are made?

What is for certain is that we will see more announcements being made on trade in the African continent from both the EU and I suspect the UK changes will happen too.

Some analysts have stated that the Brexit would surely weaken trade ties between the U.K. and African countries and with their over 100 trade agreements this will result in lengthy processes, which could cause a decrease in trade volumes with the UK, but an increase in trade volumes with the EU.

We need to keep in mind that statistics from the UK’s Office for National Statistics and the United Nations Conference on Trade and Development for 2014, only 18 months back, calculated that exports from Africa to the UK represent about 5% of Africa’s total exports and that Africa is actually more worried about China’s slowdown, its biggest trading partner by far, than that of the UK. So Africa itself needs to focus on the EU as an export partner.

We know that the East African Community and the EU are due to sign an Economic Partnership Agreement in October and there are probably other agreements in the pipeline for countries. South Africa has the UK based agreements in the Mining and Financial sector but these are in themselves not self-sustaining and job creation which is what is needed, more likely they are self-gain based.

So, financially, the bet lies on the EU and Africa – we need to manage this and watch the growth and changes, if the UK makes a move, the effect lies externally and not on us. We will flinch, but remain resilient.

Chris Green is a Financial Entrepreneur and forerunner with Mortgage Origination in South Africa. Established the first mortgage independent company in the UAE – Middle East.

chris@globalfund.com

www.globalfundi.com